Invest smarter and fundraise faster

Access the data and analytics private equity firms need to power their strategic decision-making, in one platform

Where should I invest and how do I create value?

How are my deals performing versus the market?

How do I communicate my unique approach?

Am I making the right investments?

Empowering strategic decision-making

Empowering strategic decision-making

DealEdge combines expert-built analytics with the most extensive deal performance and operations dataset available to help you assess your deal performance and deepen your understanding of subsector dynamics.

See how DealEdge can sharpen your strategy

Refine your strategy

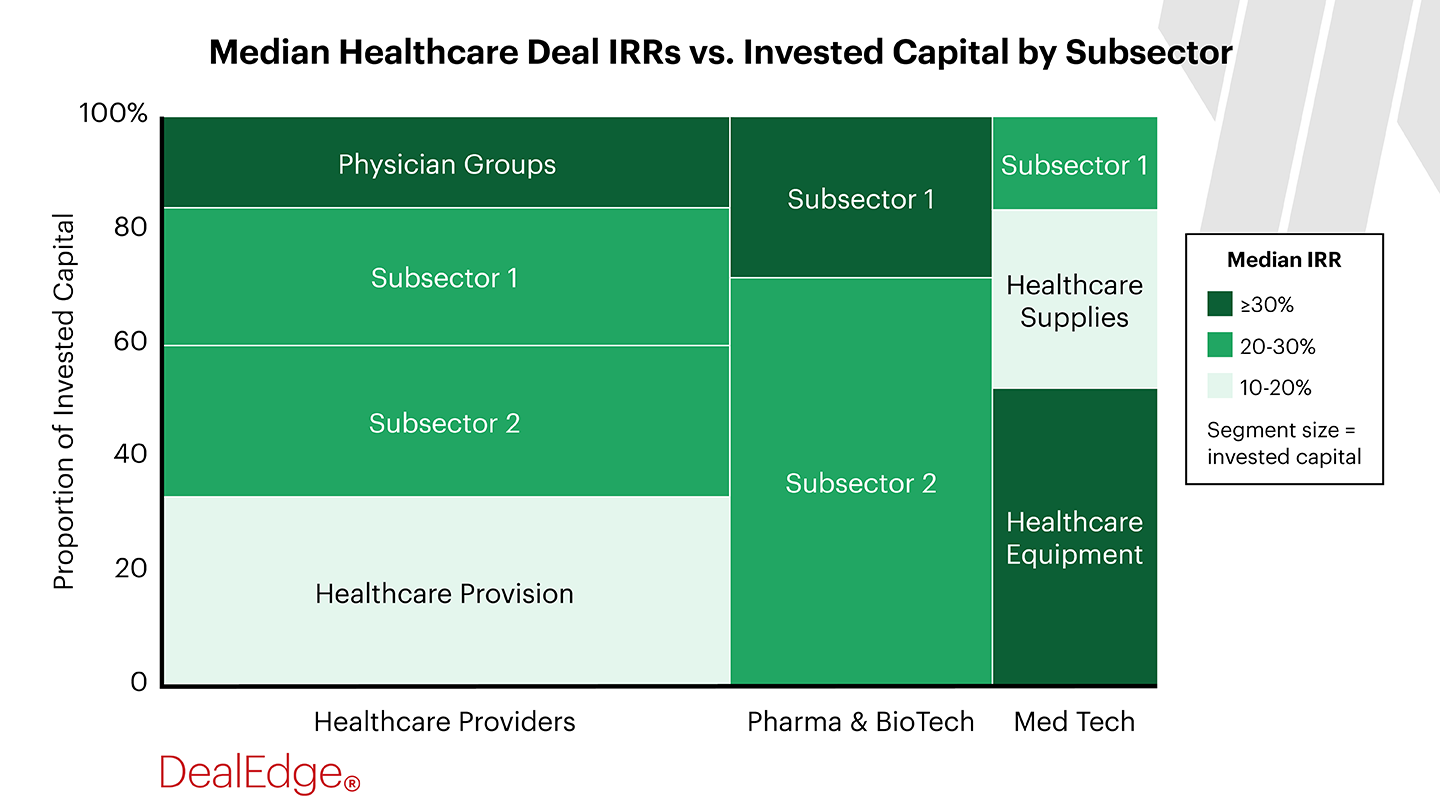

- Analyze returns across sectors and subsectors

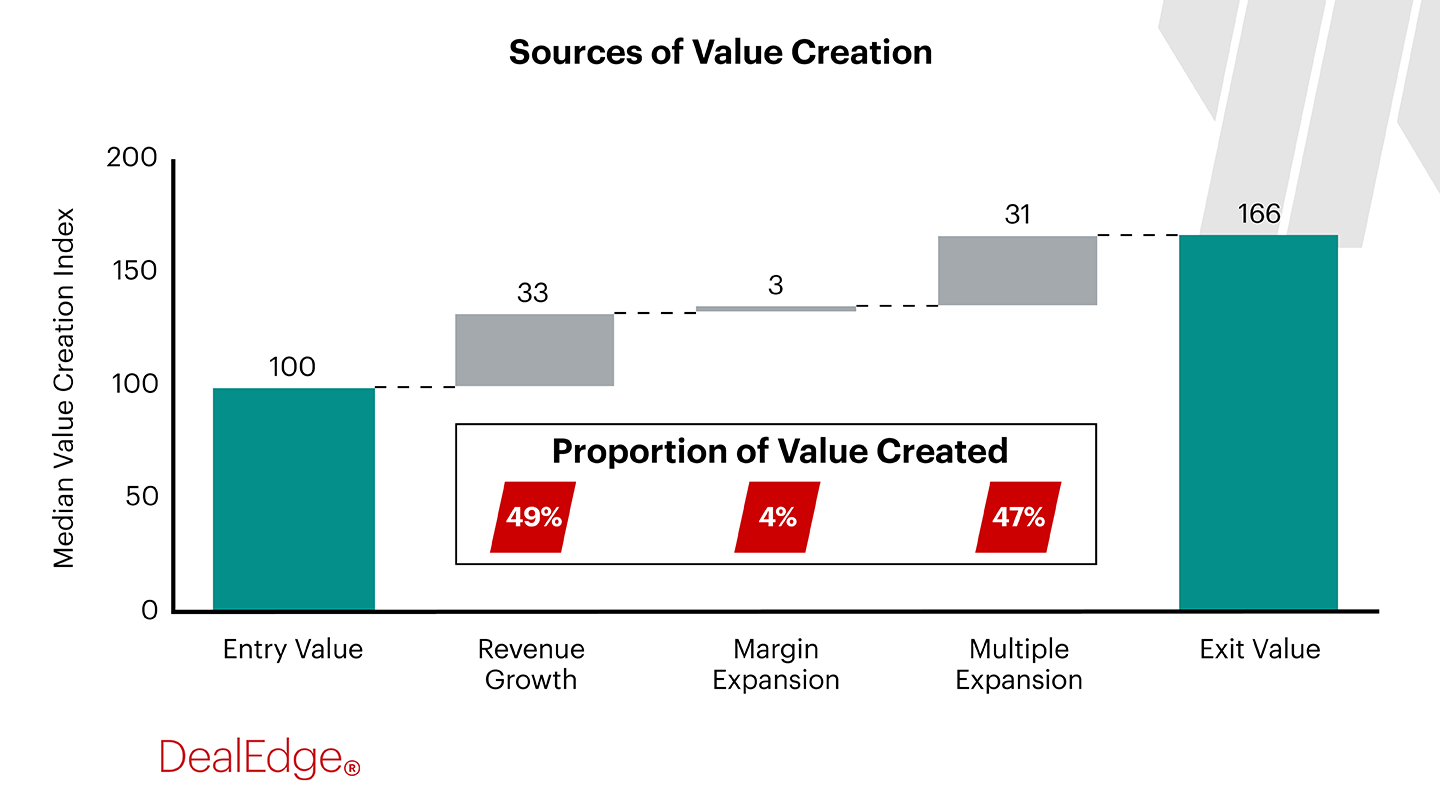

- See how value was created successfully in the past

- Review benchmarks for 570+ subsectors

Use for: strategic reviews, strategy offsites, and sector-focused performance reviews

Benchmark your portfolio

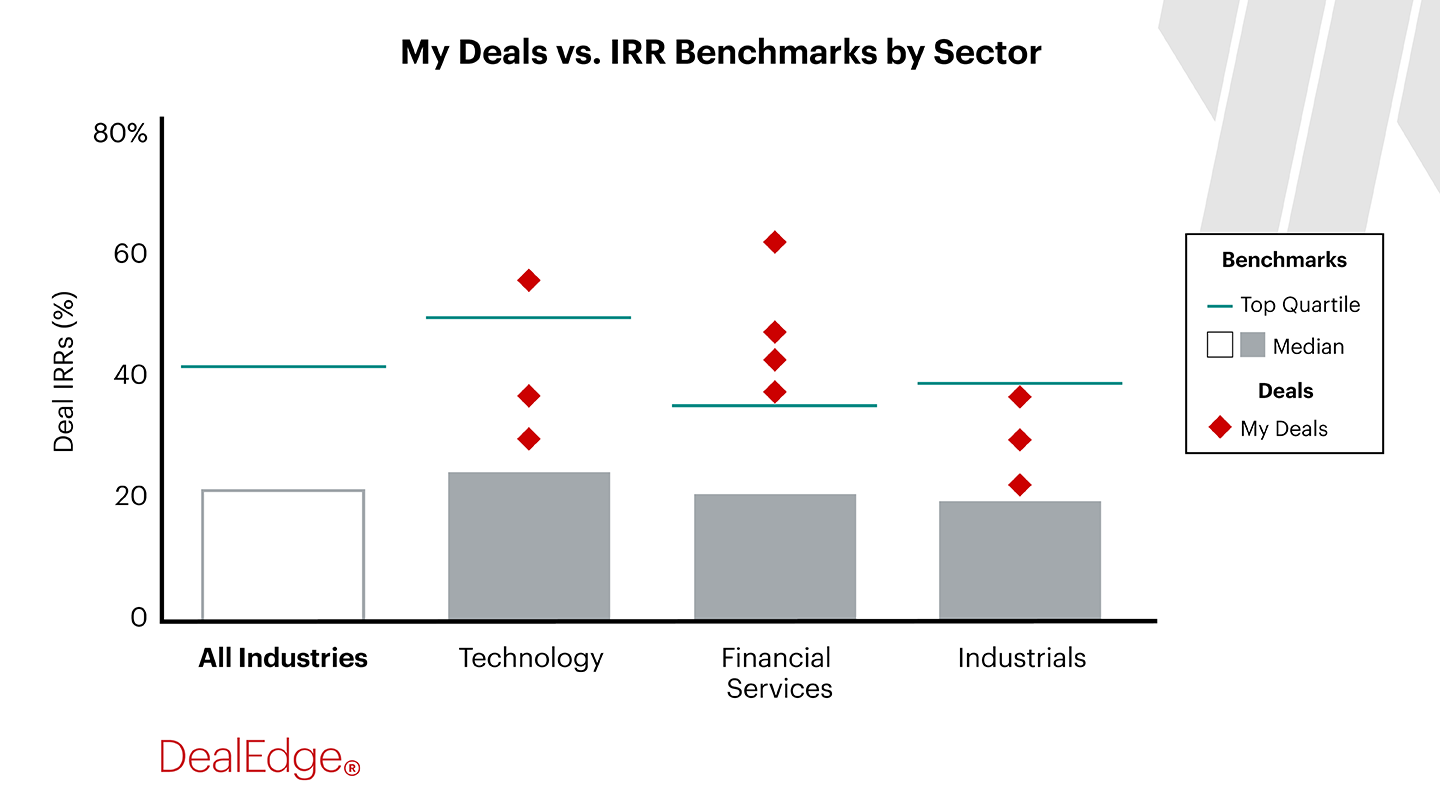

- Plot your deals against relevant deal-level benchmarks

- See where you have a demonstrated competitive advantage

- Compare your portfolio with data on 40K+ PE deals

Use for: strategic reviews, and portfolio performance monitoring / reporting

Tell your firm's story

- Showcase your outperformance and differentiate your firm

- Illustrate why your investment approach will win

- Benchmark across metrics including IRR, MOIC, and CAGR

Use for: fund marketing materials, offering memorandums and PPMs, and quarterly performance reports

Optimize your investment process

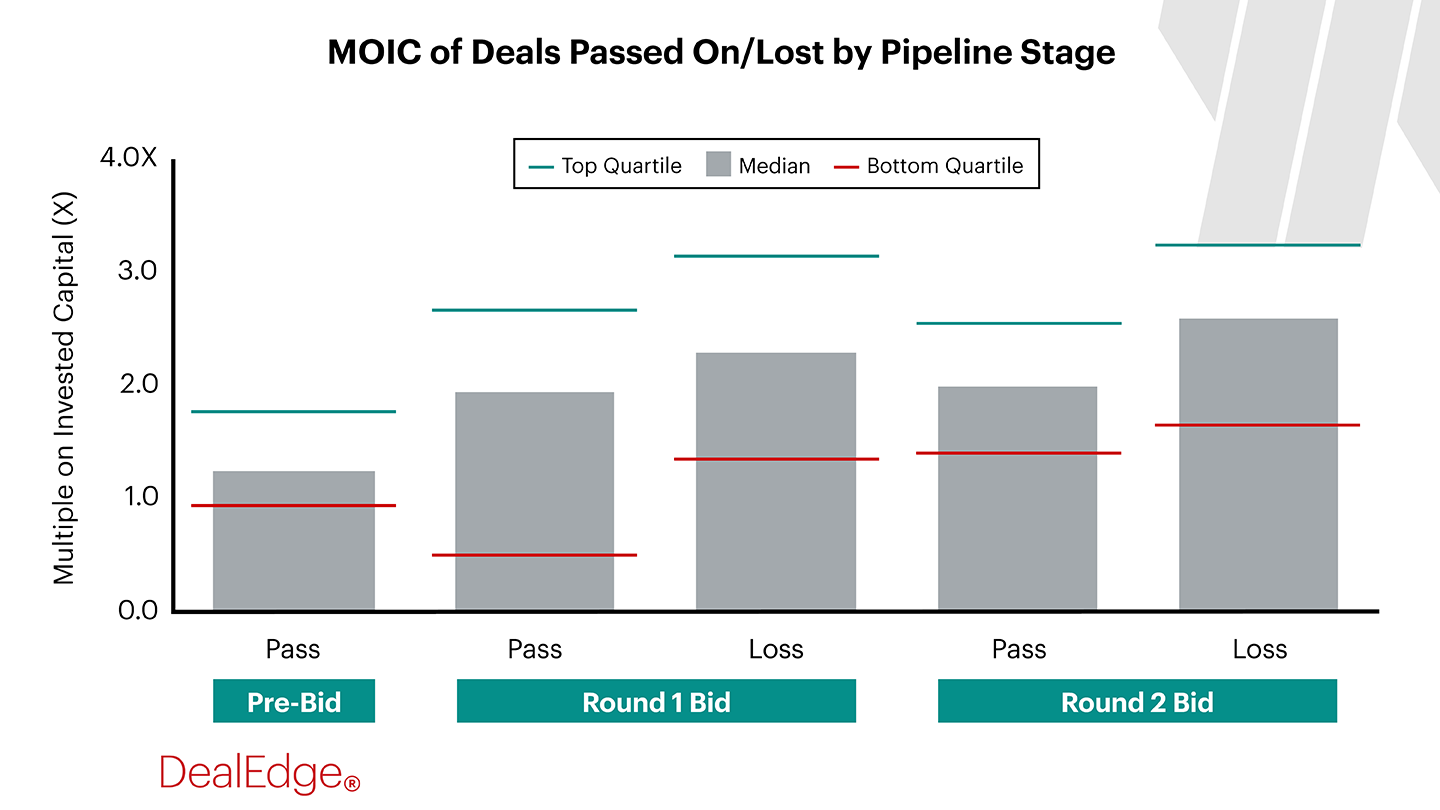

- Compare returns of deals you did with deals you passed on

- Compare returns achieved by your investment teams

- Review pricing multiples in specific subsectors

Use for: analyzing the effectiveness of your pipeline decision-making, including investment selection

“It is very easy to build and use dashboards on the product – it takes no time to learn. And if we do need assistance, the DealEdge team is very helpful and responsive!”

Brady Akman, Director of Business Development – Healthcare

Welsh, Carson, Anderson & Stowe

Get access to DealEdge's unique data

The DealEdge difference

The DealEdge difference

Deal-level data

Deal benchmarks unlock a new layer of actionable intelligence to inform your strategy.

- Data for 40K+ PE deals

- IRR, MOIC, CAGR, and more

> Our data

Intuitive analytics

Get answers to the key strategic questions facing your firm with analytics created by PE experts.

- Subsector performance maps

- Portfolio benchmarking

Deep expertise

Bain & Company has decades of experience helping private equity firms set their sector strategies.

- Tried and tested methodologies

- 570+ subsectors mapped for PE

> About us

Analyst support

Our dedicated analysts are on hand to help you get the answers you need.

- Data requests

- Custom projects

Awards and recognition

Awards and recognition

Private Equity Wire European Emerging Manager Awards 2024

Winner: Data Provider of the Year

Private Equity Wire European Awards 2024

Winner: Best Investor Relations Technology

Private Equity Wire European Awards 2023

Winner: Best Data Provider

Private Equity Wire US Awards 2022

Winner: Best Data Provider