Blog

At a Glance

Deal-level performance and operations analytics from Bain & Company give your strategy a competitive edge by helping you to:

- Find new opportunities in the market

- Benchmark your deals against your peer group

- Understand your portfolio’s key strengths

Request a demo

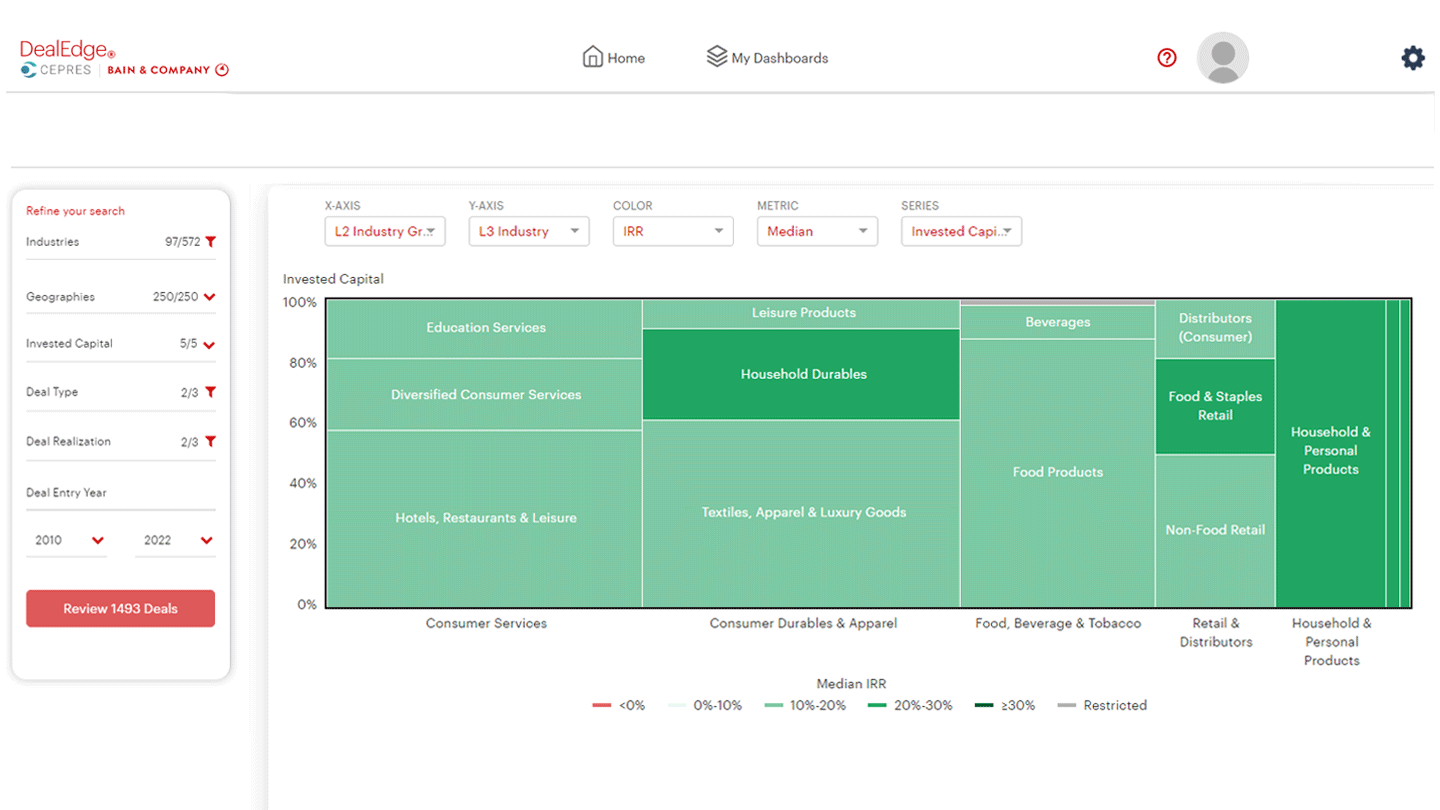

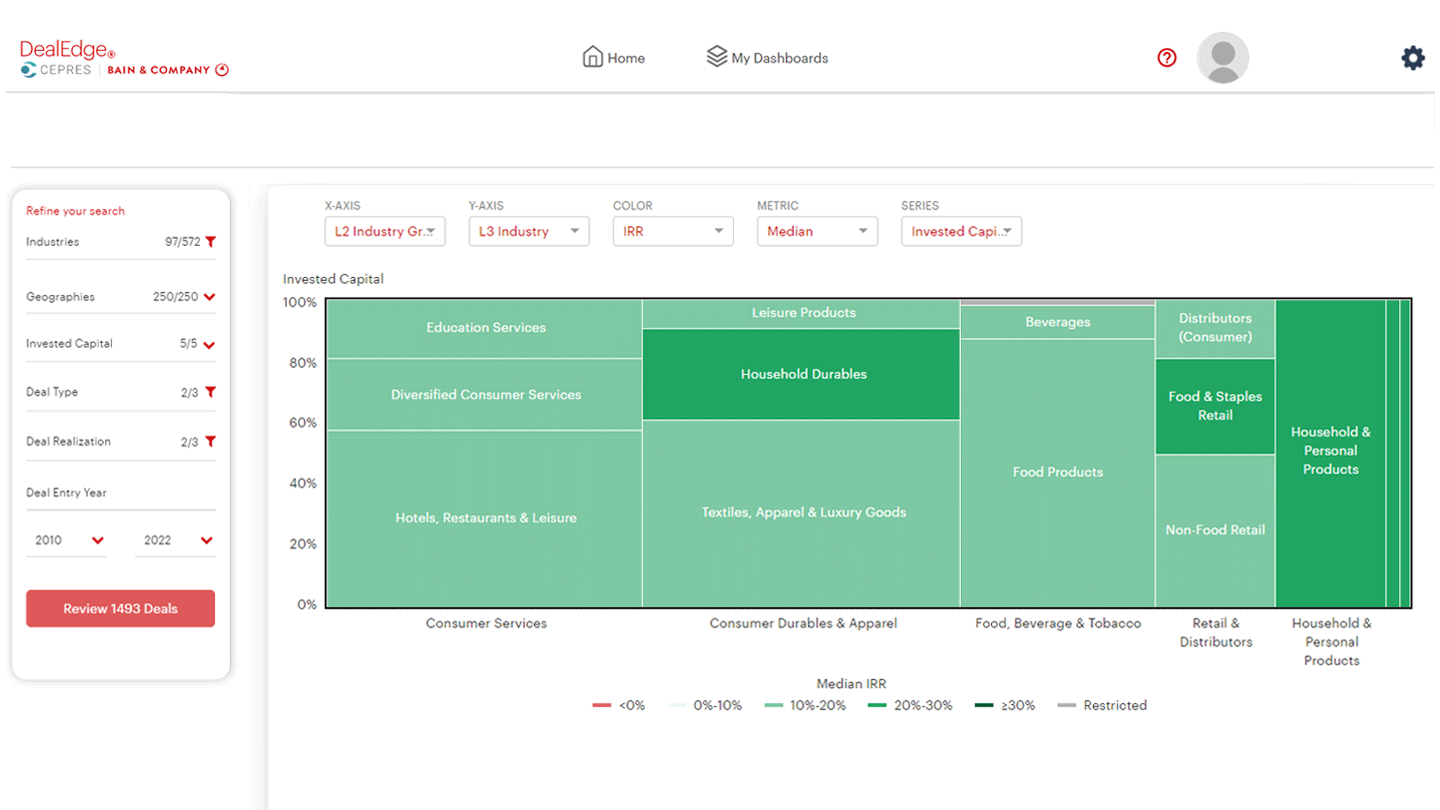

Find new opportunities in the market

In such a competitive atmosphere, specialization is key to getting an edge. With DealEdge, you can explore the private equity landscape and compare pricing, performance, and value creation in different private equity subsectors.

Powered by Bain’s private equity experience, DealEdge answers the questions you’ve always had. From broad questions like “how strong are Technology returns?” to specific inquiries like “how hot is pricing in HR Software compared to Marketing Software?”, the platform gives you at-a-glance deep insight into the state of the market.

Instantly identify areas of high returns, lower pricing, or other markers that indicate an area of potential interest. Contrast even closely related subsectors to make sure you stay laser focused on the best possible outcomes. Explore what makes those subsectors so appealing, and what it takes to win in them.

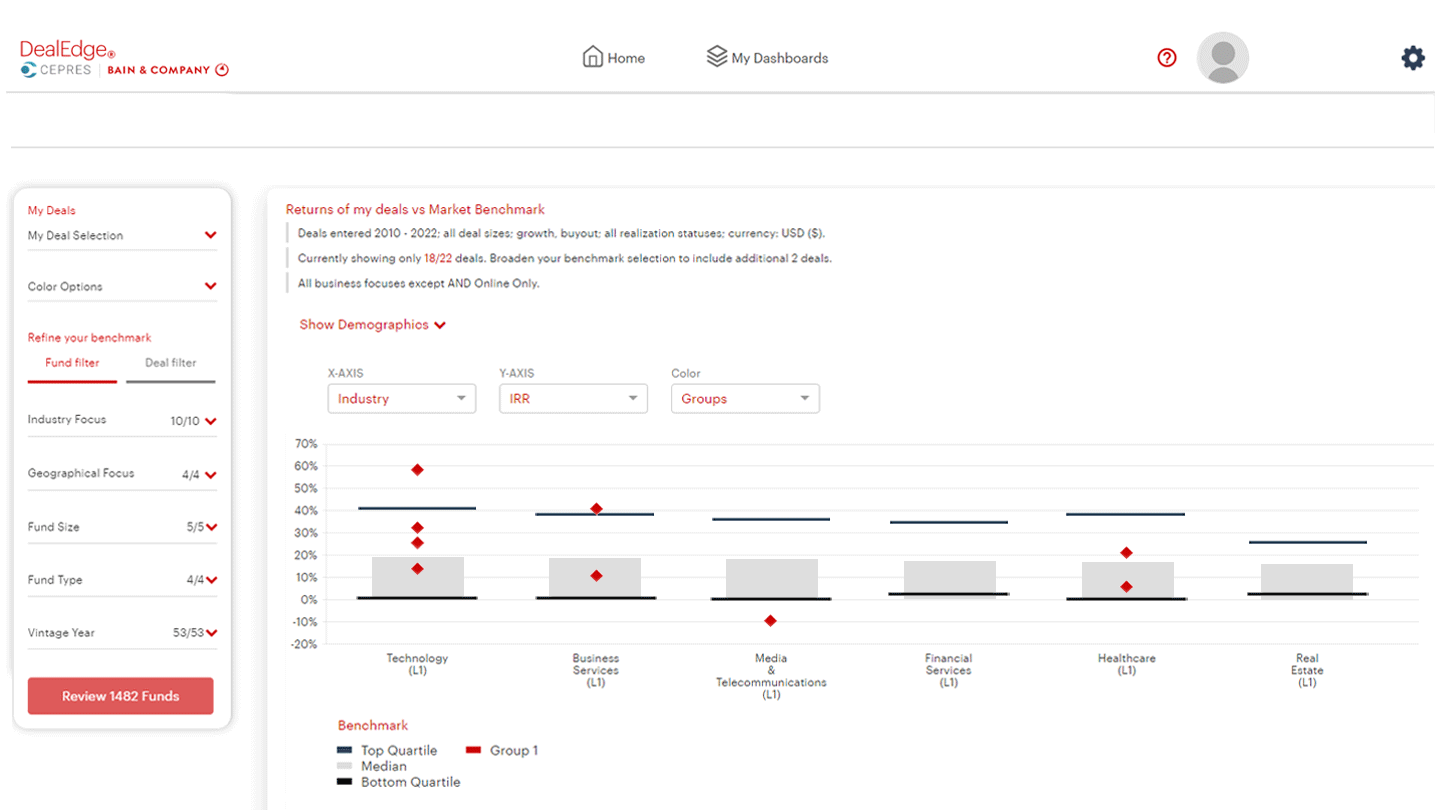

Get a competitive edge over your peers

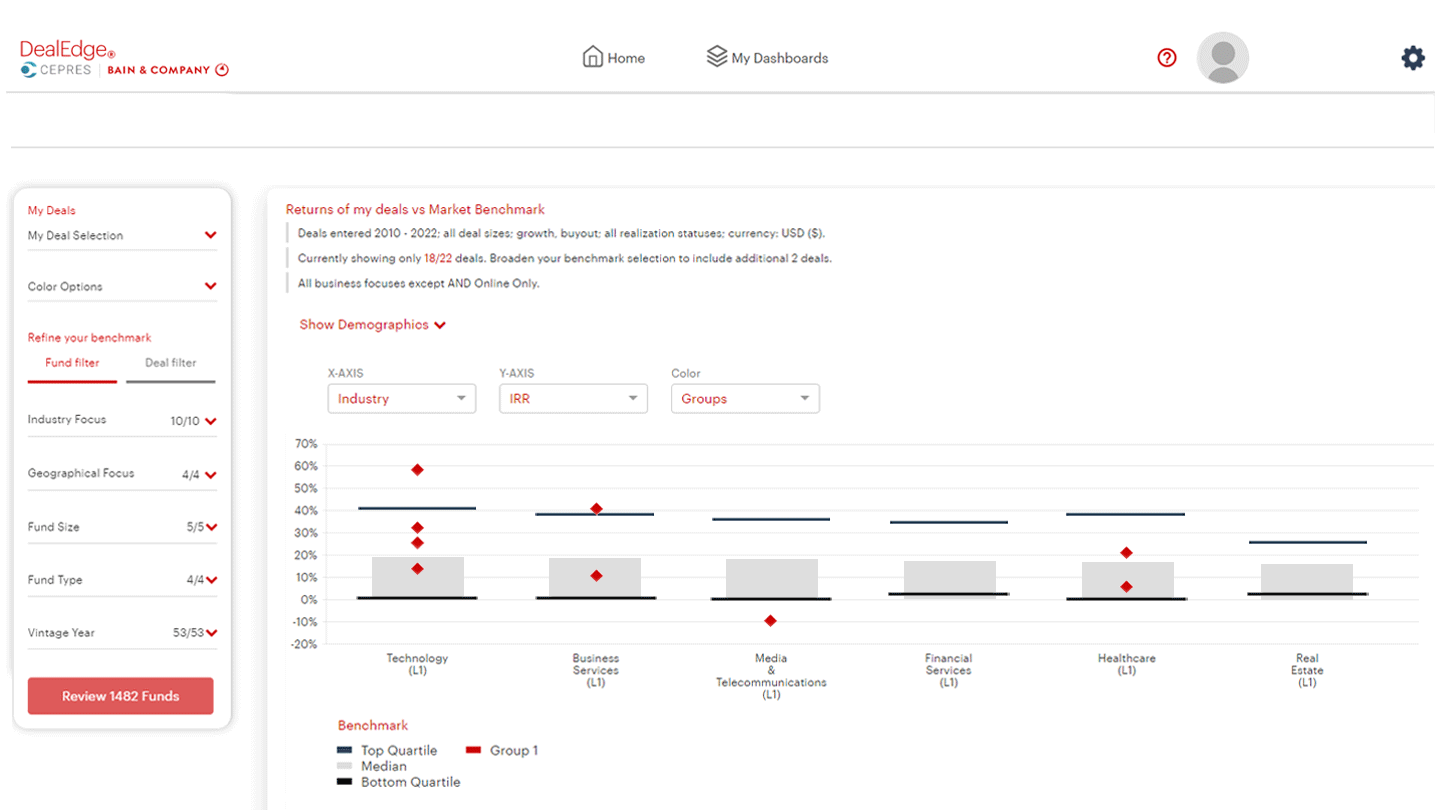

Get a better understanding of how you compare to your peer group, and identify where you can gain a competitive edge. DealEdge lets you benchmark your deals against comparable transactions across a range of performance and operations metrics including IRR, MOIC, revenue CAGR, EV/EBITDA multiple, and more.

You can also benchmark your deals against deals done by funds comparable to yours, based on their recorded deal activity. Isolate the transactions completed by your real peer group, examine where they are making deals, and how they are generating alpha. Use this intelligence to adjust your area of focus, value creation strategies, or even your approach to deal pricing.

Refine your focus by how much activity your peers have recorded in specific sectors, as well as invested equity capital size, vintage year, geographic and sector focus, and more. Drill down to just your most relevant peer group benchmarks to make sure you’re leveraging the most actionable competitive insights.

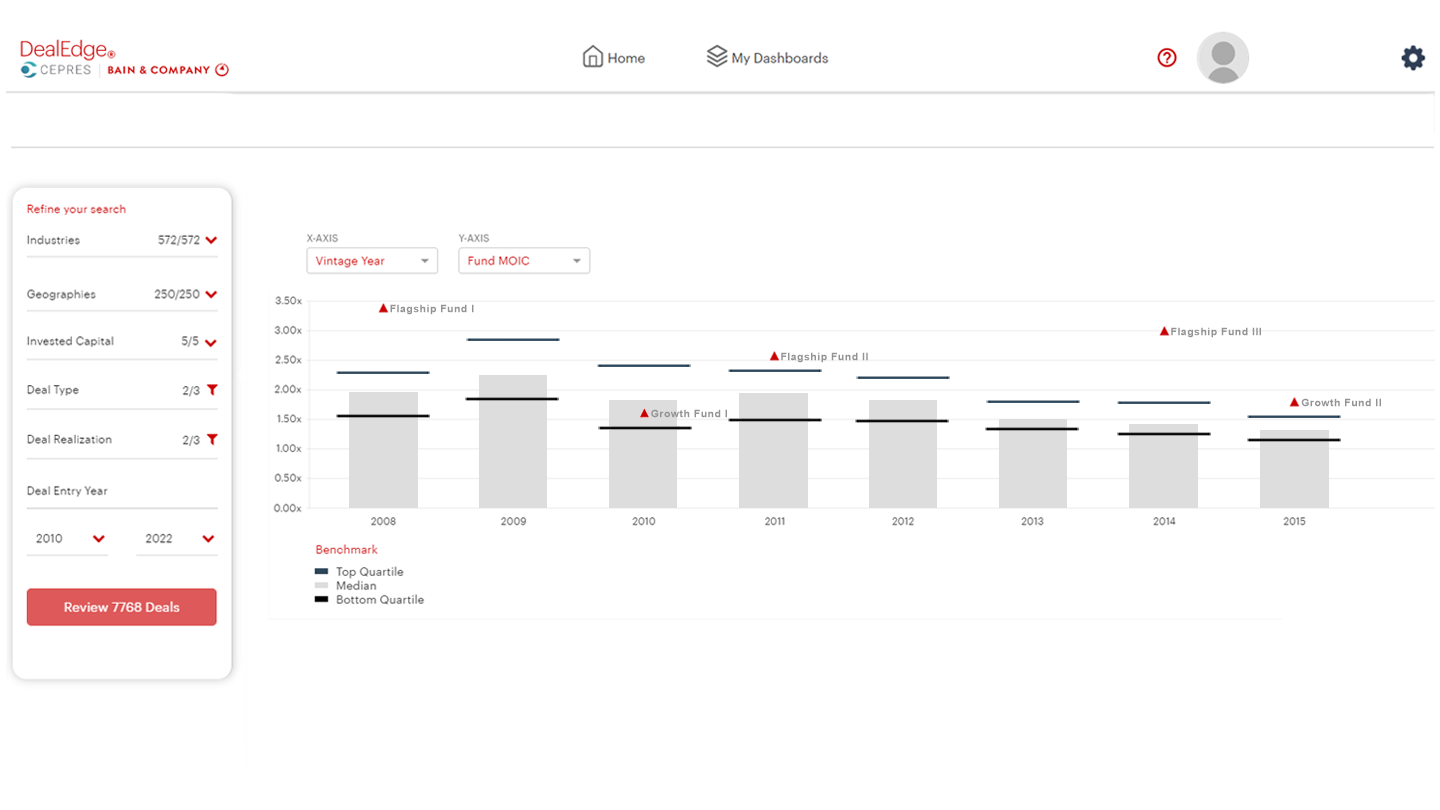

Understand your key strengths

As well as comparing your deals to your peer group, you can also conduct in-depth analysis of your own performance and value creation. DealEdge connects your data sources, combining insights from your own cash flows and portfolio operations data. It offers ready-built analysis of how you generate alpha in your deals, and how that compares to winning deals in your subsector.

Examine your performance in individual sectors, single funds, or your entire portfolio. Easily identify where your deals are performing in the top quartile, and where you’re lagging the sector leaders. Explore whether you are creating value differently, or if your entry pricing multiples are competitive for your specific area of focus.

Sharpen your strategy with the best possible intelligence

DealEdge has a wealth of expert analytics to help you understand your sectors, your peer group, and your own activity. It is shaped by decades of private equity expertise from industry leaders Bain & Company, and based on CEPRES’s market-leading cash flow data. Our insights are based on more than 39,000 private equity deals across more than 570 industry subsectors.

Deal-level analysis is the most granular, most actionable way to refine your strategy, analyze your peer group, and make sure that you maintain your performance edge. See how DealEdge can help you invest smarter and maximize your potential today.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo