Blog

At a Glance

The latest update from DealEdge combines private equity deal-level benchmarks with fund-level filters. Compare your deals against equivalent deals done by funds like yours, so you can:

- Benchmark yourself against your most relevant peer group

- See exactly where you have a competitive edge and how your peers create value

- Refine your pricing parameters, value creation strategy, and sector focus with concrete competitive intelligence

Request a demo

What is peer group analysis?

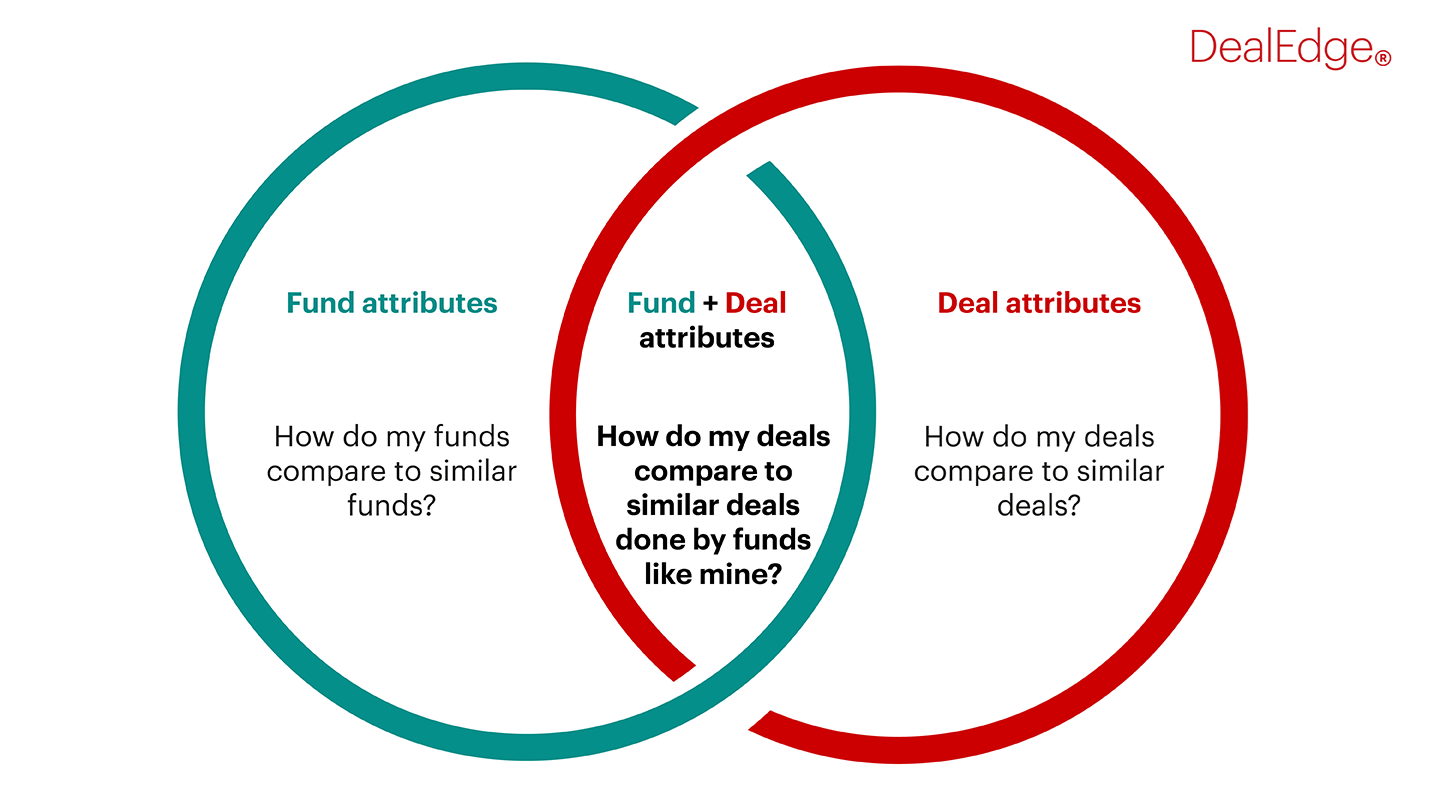

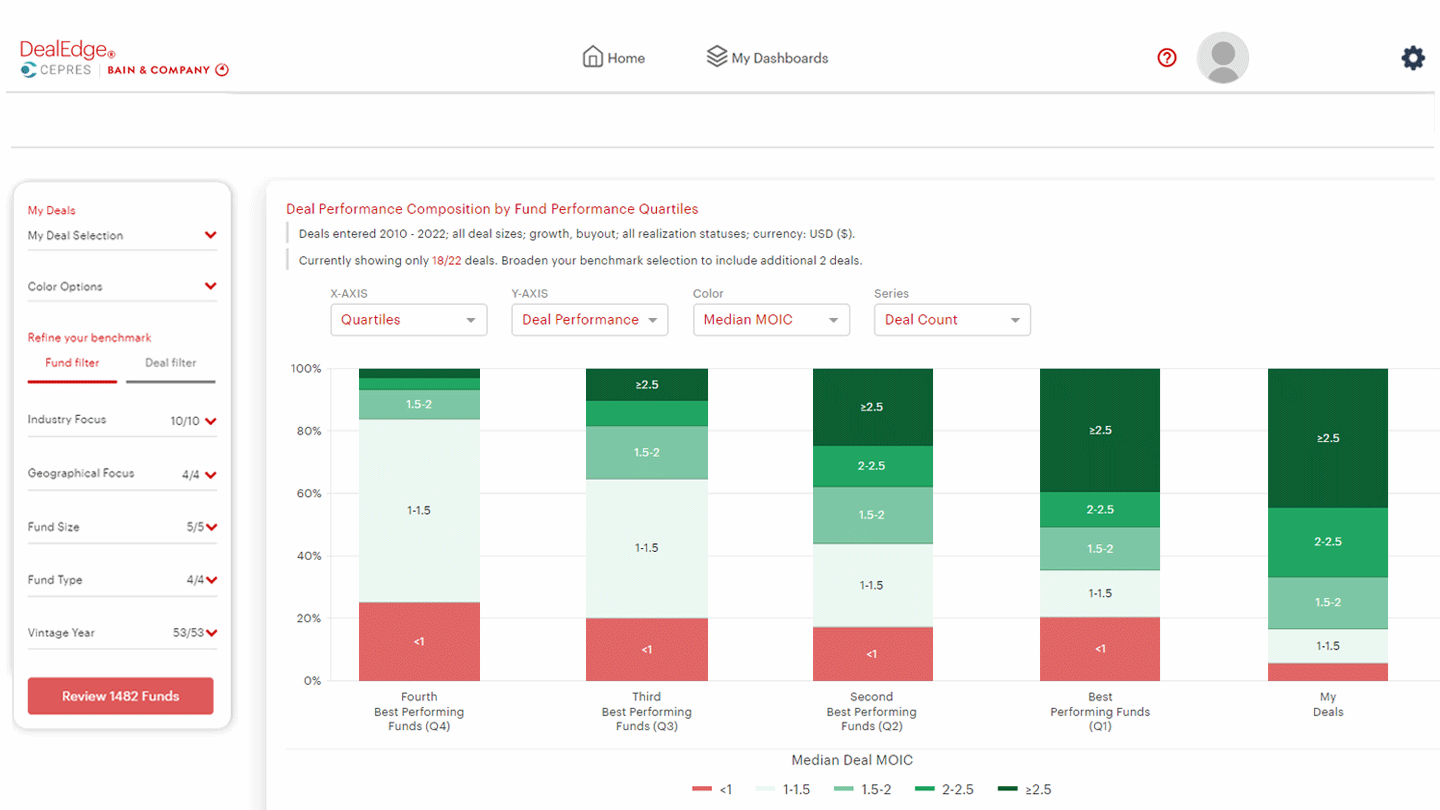

Peer group analysis combines the specificity and granularity of deal-level benchmarking with the competitive lens of fund-level profiling.

This means that for the first time, you can benchmark your deals against similar deals done by funds like yours. Compare single deals, assess the performance composition of your fund, or evaluate your complete portfolio.

The result is a shift from market trends to actionable intelligence for your fund: discover specific benchmarks for deals in your market niche that were done by funds like yours.

Benchmark yourself against the actual reported activity of funds like yours, and get a like-for-like comparison of pricing, operations, and performance.

How can it help me?

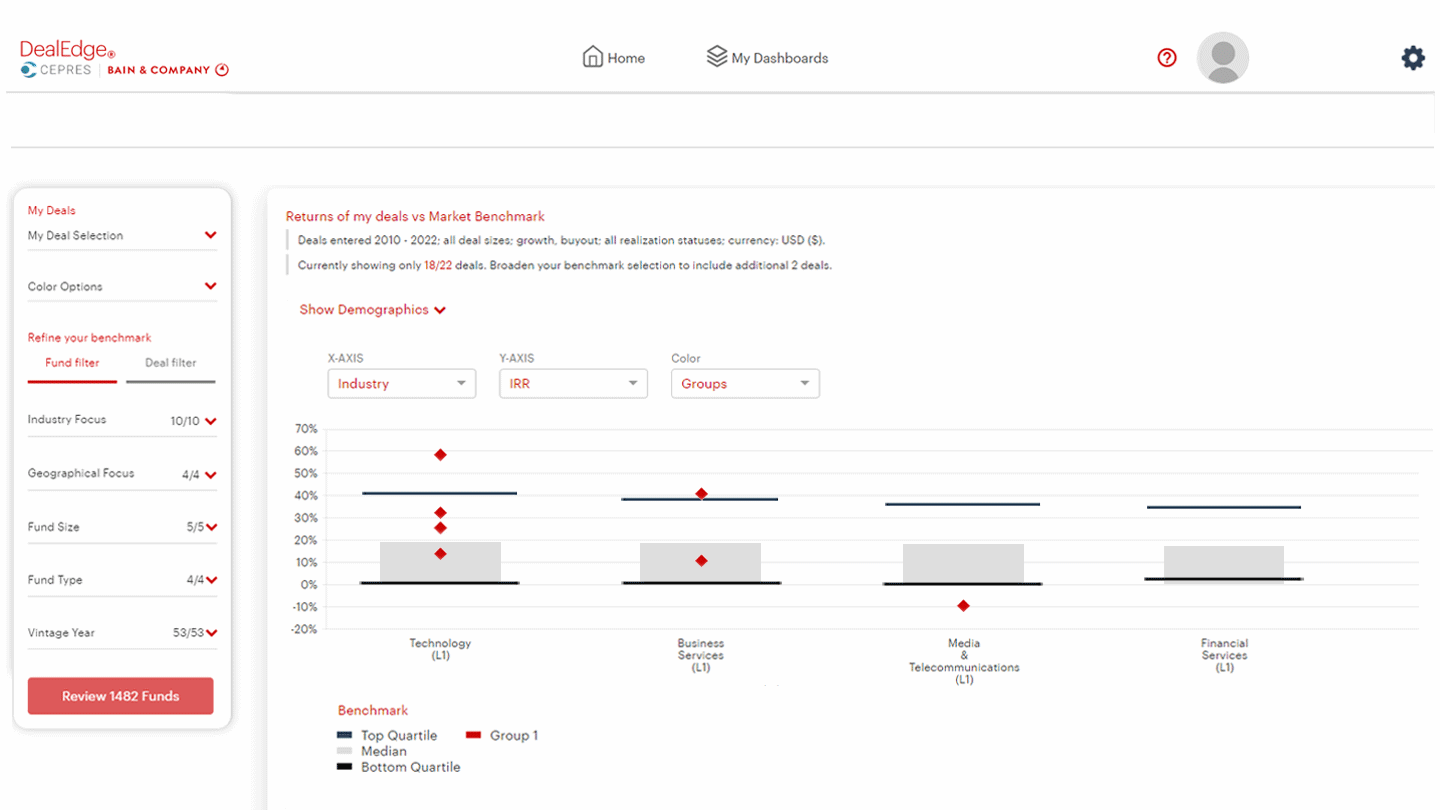

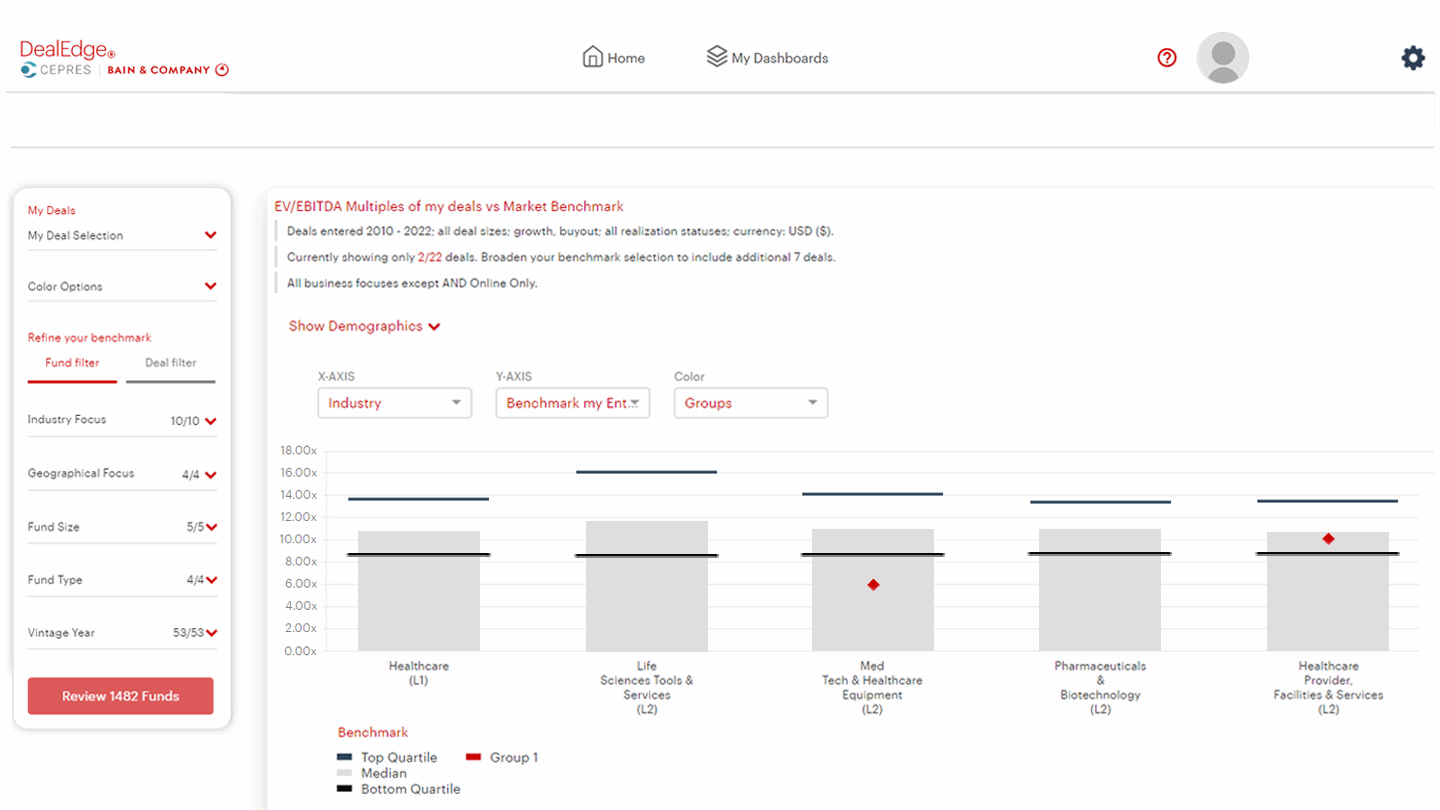

With DealEdge, you can benchmark your deals against their most comparable counterparts across more than 20 performance and operations metrics. This ranges from EV/EBITDA pricing multiples, to revenue CAGRs, to deal-level IRRs.

It’s a step beyond contextual market data. You can now immediately answer specific questions like “Am I overpaying in certain subsectors compared to other funds like mine?” or “Are funds in my peer group managing to expand their margins more in Europe than I am?”.

This kind of intelligence is a breakthrough for the private equity industry, offering concrete quantitative analysis in place of partial datasets and anecdotal evidence. You can use the findings to refine your pricing strategy to particular subsectors, to assess your value creation approach in specific deals, or even to evaluate your overall sector or regional focus.

The specificity of deal-level analysis provides an unmatched depth of insight, while the fund-level filters offer that insight through your own personal competitive prism. There is no higher standard of actionable intelligence.

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

How do I build my peer group?

You can adjust your peer group in two easy steps:

- Select the fund characteristics of the peer group you want to compare yourself against. Set the vintage year, size, and industry filters to narrow the universe to your area of focus.

- Refine your peer group based on their industry exposure. Specify funds based on the proportion of registered deal activity in a given sector – not just what it says on their website.

What can the platform do?

There are more than 20 different analyses that DealEdge provides, ranging from deal-level performance benchmarks to value creation breakdowns to loss ratios.

Some of the key features of the peer group analytics are:

- Compare yourself against your most relevant peer group. Track deal performance, pricing, alpha generation, and downside risk factors among funds operating in the same areas as you

- Set minimum exposure thresholds for specific industries to benchmark yourself against what peer group funds are actually doing, not what they say they are doing

- Home in on specific subsectors or geographies, and examine how your deals in these areas stack up against comparable transactions

- Break down the performance of constituent deals in your peer group funds compared to the deals in your funds

DealEdge’s insights are backed by the award-winning CEPRES platform, which covers more than 39,000 private equity deals across more than 570 industry subsectors. The analytics are built by industry experts Bain & Company, drawn from their extensive experience in providing winning guidance to the market.

What next?

If you would like to see the platform in more detail, and understand exactly how peer group analysis can help you to sharpen your competitive edge, then please get in touch to see it in action.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo