Over the past decade, private equity investors in software have excelled at creating value through revenue growth. However, according to Bain & Company’s 2025 Global Private Equity Report, margin expansion has been largely absent from the equation.

A proprietary analysis of 33 software buyouts in Bain’s report found that 94% of deals projected significant margin growth—yet actual margin expansion consistently lagged expectations after five years of ownership.

"Expanding margins is almost always a part of a software buyout deal thesis. Delivering on those projections turns out to be another matter altogether."

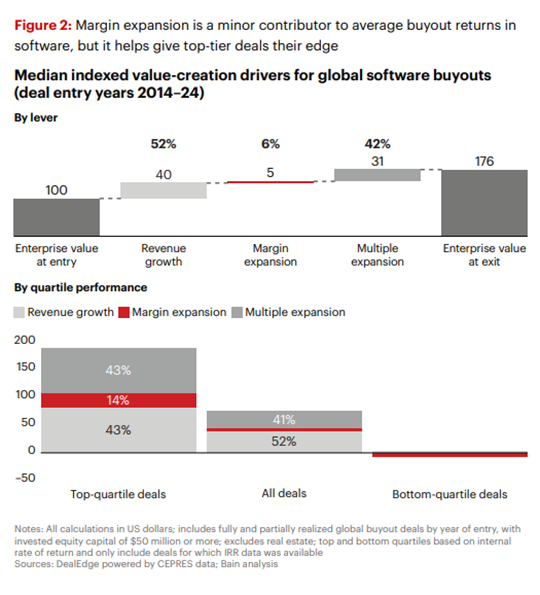

DealEdge data cited in Bain’s report underscores this trend. Looking at 762 Software deals over the last ten years:

- Revenue growth has accounted for 52% of total value creation in software deals.

- Multiple expansion contributed another 42%.

- Margin expansion, by contrast, added just 6%—and nearly all of that came from top-quartile deals.

Despite widespread expectations for operational improvements, the report highlights that the gap between underwriting and execution remains a major challenge in software investing.

How Top-Quartile Software Deals Get It Right

Despite these challenges, Bain’s 2025 Global Private Equity Report finds that top-quartile software deals do succeed at margin expansion. According to Bain’s analysis, these successful deals tend to follow a more integrated due diligence and execution approach:

- A holistic diligence process – Bain finds that firms with a fully integrated due diligence approach—combining commercial, technical, and operational intelligence—are better positioned to achieve both revenue growth and margin expansion.

- A structured approach to margin expansion –The report highlights that top-quartile deals tend to include clear plans for pricing optimization, productivity improvements, and go-to-market efficiency.

- Execution discipline from Day 1 – Bain’s research shows that winning software deals don’t treat margin expansion as an afterthought. Instead, they incorporate efficiency measures into their post-close execution plans and actively track progress to ensure margin growth materializes.

Benchmark Software Deal Performance with DealEdge

Bain’s 2025 Global Private Equity Report makes one thing clear: As tech growth slows and valuations remain high, margin expansion will be key to sustaining strong returns in software PE investing.

With DealEdge, investors can:

- Benchmark deal performance: Look at value creation drivers, returns, loss rates, multiples and more across software subsectors, geographies, deal sizes or other points of interest

- Enhance Portfolio Benchmarking: Compare your software deals against a vast database of over 50,000 private equity transactions to evaluate performance relative to industry peers and identify areas for improvement.

By leveraging DealEdge's data-driven insights, investors can navigate the evolving software investment landscape with greater confidence and precision.

Want to see how your next software deal compares? DealEdge offers the industry's most comprehensive benchmarks for software PE investments.

Looking for more on Value Creation in Software? Check out: Driving Exit Success: Operational Excellence and Value Creation in SaaS Investments