Report

Download the Full Report

Download the Full Report

See deal-level IRRs, entry multiples, and sector-specific outcomes during the Global Financial Crisis — with insights that are highly relevant to today’s market.

What You'll Learn

What You'll Learn

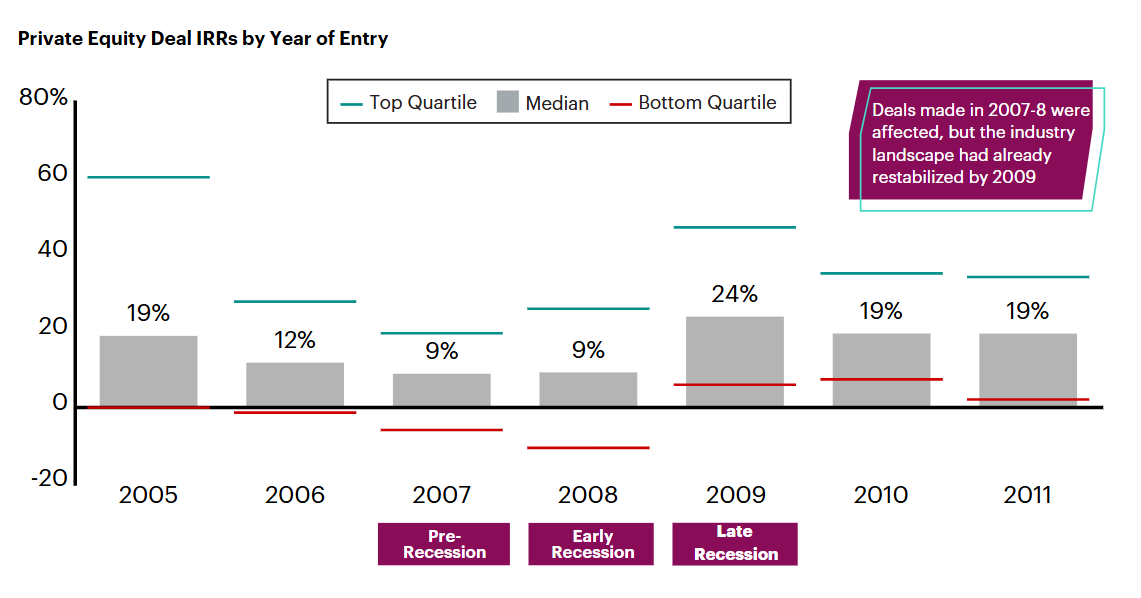

- How deals made during the GFC outperformed those made before it

- Which sectors saw the biggest IRR rebounds in 2009

- How entry multiples compressed — and created upside

- The true risk: % of deals returning MOIC <1.0x across 3 key years

- Actionable insights for today’s PE environment

Backed by the Most Granular PE Deal Data

Backed by the Most Granular PE Deal Data

✔ 50,000+ deals analyzed

✔ Mapped to Bain's proprietary taxonomy called, BPICs

✔ Sector-by-sector IRRs from 2007–2009

✔ Based on realized and partially realized buyout & growth deals in North America and Europe

Want to know which sectors held up best — and when to lean in?

Download the DealEdge Recession Case Study and make your next move with conviction.

DOWNLOAD NOW

More from DealEdge

Sharpen your investment edge

Speak to us today about how you can power up your private equity program

Register for Demo