Blog

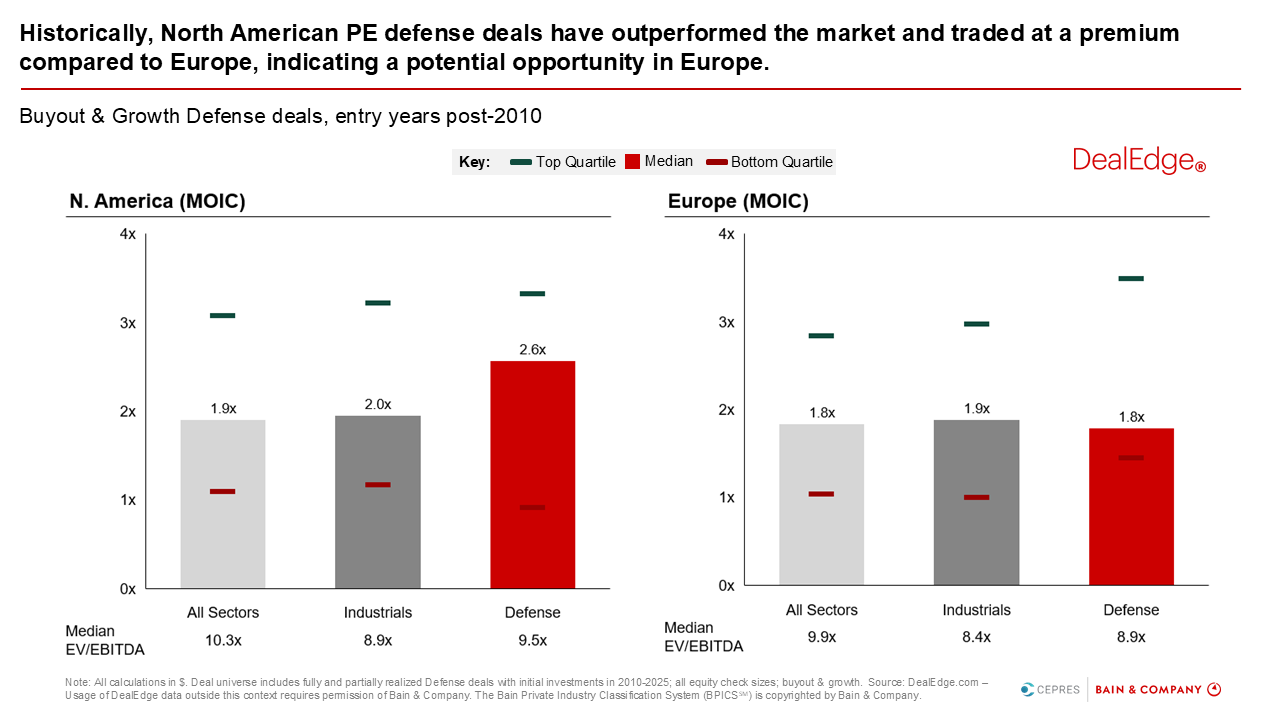

Private equity has long found outsized returns in Defense, but most of that success has been concentrated in North America. According to DealEdge data, North American private equity Defense deals delivered a median MOIC (Multiple on Invested Capital) of 2.6x since 2010. That’s significantly higher than returns across Industrials (2.0x) and the broader market (1.9x).

In contrast, European defense deals have returned just 1.8x on a median basis, despite comparable entry valuations (EV/EBITDA of ~9x).

That historical underperformance, however, may now represent an opportunity.

A Turning Point for European Defense Investing

Recent developments suggest Europe’s defense sector may be on the cusp of a major revaluation. According to PitchBook’s Q1 2025 Aerospace and Defense Report, deal activity is already surging:

- €620 million (approx. $704 million) in private equity investment across 12 deals was recorded in Q1 2025 alone

- 2025 is on pace to match or exceed the post-Ukraine invasion boom in defense deals.

This isn’t a temporary spike, it’s the early stage of a structural shift in the European defense market.

Unprecedented Public Spending Momentum

Governments across Europe are opening their budgets in ways not seen since the Cold War:

- In March 2025, the European Commission launched the ReArm Europe program, a 10-year plan to mobilize €800 billion to rebuild the continent’s defense manufacturing capabilities. European Commission

- The EU also approved a €150 billion loans-for-arms facility to finance ongoing military needs as the Russian-Ukrainian conflict continues. Politico EU

- Germany, now the world’s 4th largest defense spender, plans to increase its defense budget toward 5% of GDP, following recent parliamentary support to exempt military spending from debt limits. SIPRI Military Spending Report German MoD

Other countries, including Poland, Sweden, and Denmark, are also rapidly scaling their defense commitments, spurred by shifting NATO expectations and domestic security priorities.

Private Equity Implications

The fundamentals are aligning for European defense to become a high-growth, high-return sector, similar to what the U.S. has already demonstrated. According to DealEdge data:

- North America: Defense deals outperformed all sectors on both a median MOIC and valuation basis.

- Europe: Valuations are comparable (median EV/EBITDA of 8.9x for defense vs. 10.3x for all sectors), but returns have lagged, suggesting untapped upside potential.

As government demand and capital spending surge, European defense assets may benefit from margin expansion, order growth, and platform-building opportunities - all of which align with private equity’s playbook.

Signals from the Public Markets

Investor interest is already showing up in public equities:

- Rheinmetall (Germany) reported a 46% YoY increase in Q1 2025 sales, reaching €2.3 billion, driven by surging government orders. Rheinmetall Investor Relations

- Thales Group (France) confirmed 5%–6% organic growth, with strong performance in defense and cybersecurity segments. Thales Q1 2025 Earnings

These signals point to strong fundamentals across the value chain, from defense manufacturing and cybersecurity, to enabling tech and services.

The Bottom Line

For years, Europe’s defense market was viewed as fragmented, underfunded, and slow-moving. But with massive fiscal programs, geopolitical urgency, and investor attention converging, that perception is changing rapidly.

The performance gap identified by DealEdge shows what’s possible when conditions align, and the macro signals from PitchBook and public markets suggest Europe is now primed to deliver.

For investors, the question isn’t just whether Europe will catch up, it’s who will get there first.

More from DealEdge

Sharpen your investment edge

Speak to us today about how you can power up your private equity program

Register for Demo