Blog

At a Glance

Upgrade your scenario planning with the PE industry’s most sophisticated valuation and operations analytics platform. With DealEdge, you can:

- Model how market downturns might affect valuations across your portfolio

- Calibrate your value creation approach to maximize returns and minimize risk

- Explore what new opportunities market turbulence might produce

Recent interest rate turmoil has underlined the importance of being prepared for sudden and significant shifts in the market. Private equity firms are hard-pressed to understand exactly how their investments might be impacted by adverse conditions, and how they can best position themselves moving forward.

Being able to minimize downside risk and take advantage of potential opportunities requires reliable and actionable intelligence. DealEdge’s performance and operations metrics can enhance scenario planning significantly. They give GPs more certainty in how to benchmark their holdings, how to model how those holdings might respond to different market conditions, and in spotting potential opportunities that may arise.

Modelling your portfolio valuations

Understanding how different holdings are valued during and following market downturns is a challenging and subjective part of scenario planning. DealEdge’s sector-specific benchmarks give GPs greater confidence in how to value their holdings:

- Examine how different types of holdings are valued in downturns: DealEdge has the PE industry’s largest valuation and operations dataset, so GPs can see how the performance of companies like theirs have been affected in previous downturns.

- See how your portfolio might be impacted: with DealEdge’s extensive operations analysis and risk metrics, GPs can benchmark how their valuations might be impacted by market turbulence, and assess what parts of their portfolio may be at greater risk.

Adjusting your value creation approach

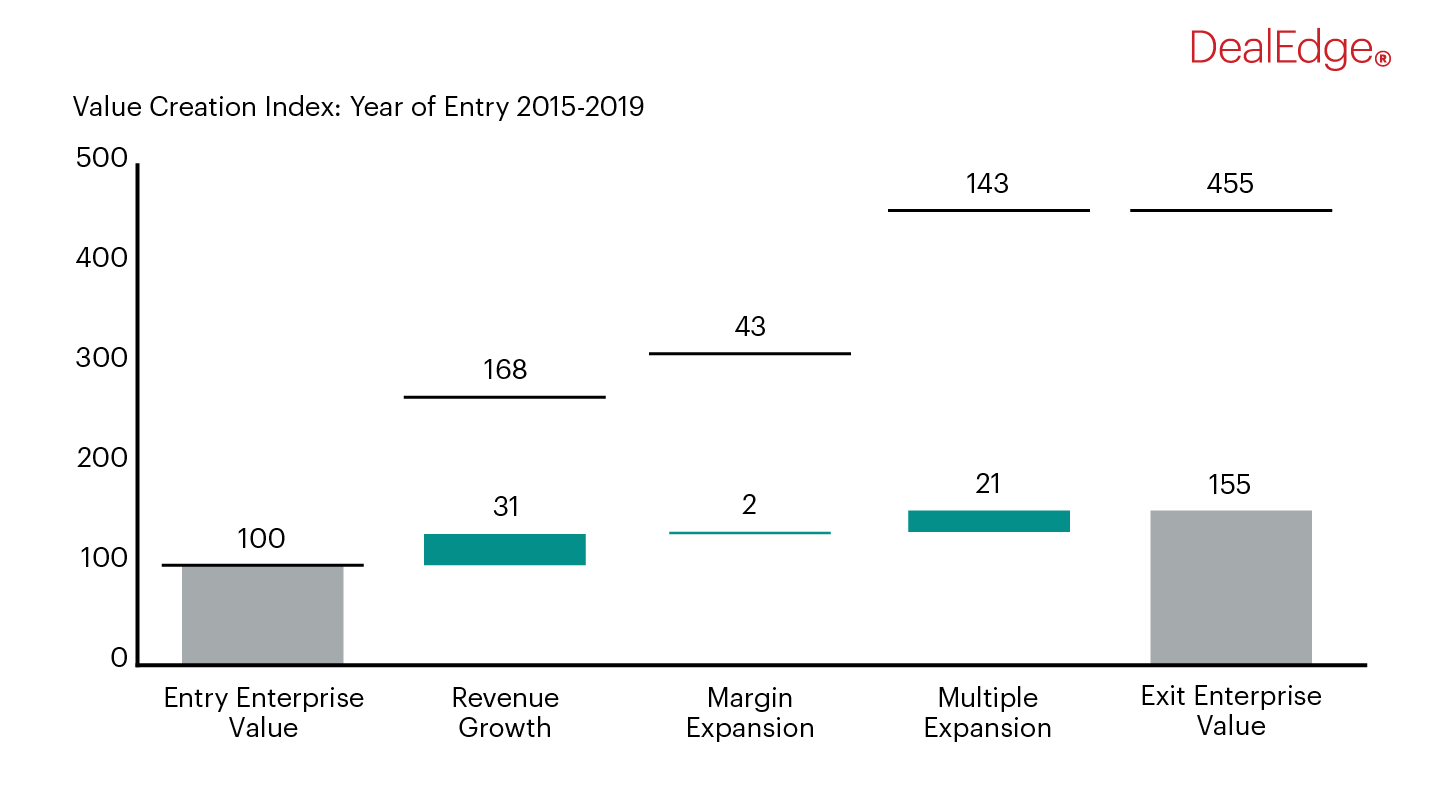

Once GPs have modelled how market downturns might affect their portfolio, the question remains: how to make the most of the disruption? DealEdge’s value creation analytics allow them to tailor their approach to maximize any opportunities:

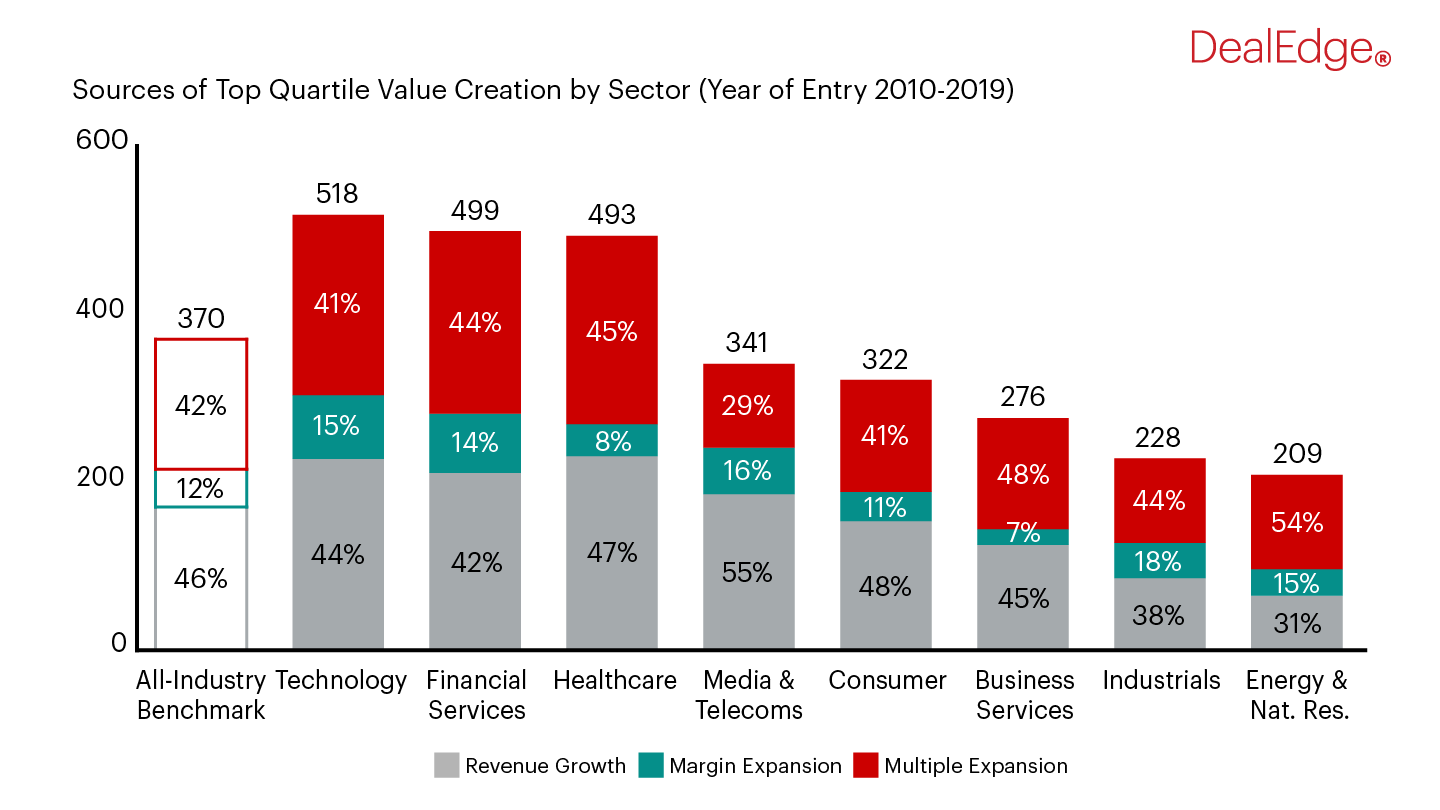

- Map the PE performance landscape: DealEdge shows how market dynamics can have different impacts on even closely related industry sub-sectors. GPs can instantly understand which areas are exposed to greater downside risks, and which ones might see significant upside potential.

- See how winning deals create value: DealEdge’s unique operations analytics don’t just indicate how well winning deals performed. They also demonstrate exactly how outperforming deals created value. This means GPs can see how successful deals in their specific sub-sector managed to perform during historic turbulence.

What next?

DealEdge’s groundbreaking performance and operations analytics can add clarity and confidence to your scenario planning. Whether you are modelling the impact on your portfolio, assessing your value creation strategies, or seeking to deploy capital into opportunities that might arise, DealEdge gives you a key competitive edge.

For a sample of the kind of analysis that is possible on the platform, download DealEdge’s latest report on value creation. It explores what defines a top quartile value creator, and includes breakdowns of the different value creation levers according to year, sector, size, and more.