Blog

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

Straddling the healthcare and technology sectors, Healthcare IT has been an area of particular focus for private equity investment in the past 10 years. While the businesses themselves may be technology companies, DealEdge analysis finds that they have historically performed very similarly to the wider healthcare sector.

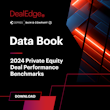

As of the end of 2021, the median IRR for Healthcare IT businesses acquired since 2010 is 26.2%, on par with the 26.9% seen in other healthcare companies (Fig. 1). The distribution of returns across quartiles is also similar in the two segments, with both the upper and lower quartile boundaries sitting within two percentage points of one another.

“The pandemic has accelerated the use of digital tools that leverage big data and machine learning in every health sector, helping to make many operations more efficient and spur innovation. The result could be better health outcomes at a lower cost.”

Bain Global Healthcare Private Equity and M&A Report 2022

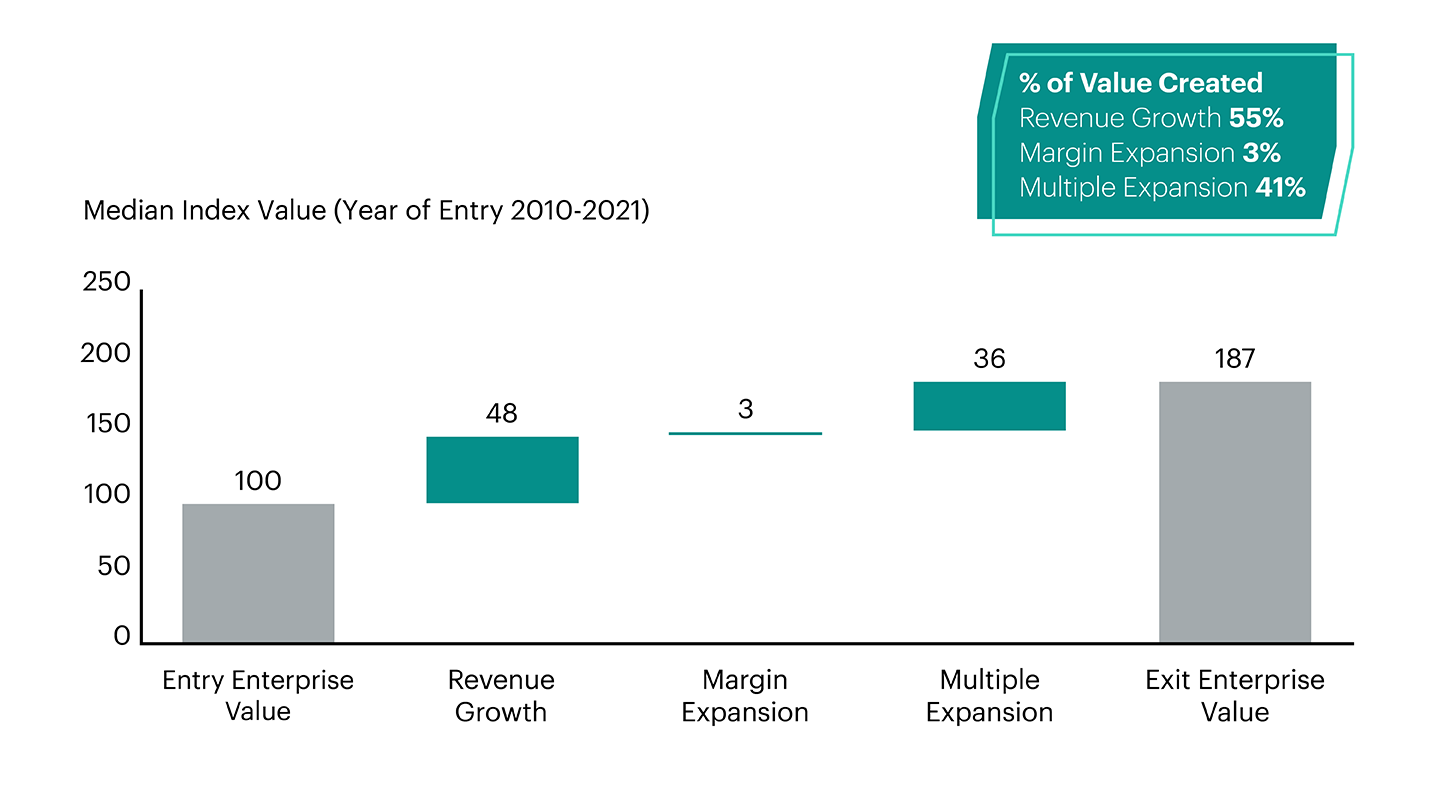

Moreover, Healthcare IT businesses invested since 2010 have created value in the same way as their healthcare counterparts (Fig. 2). On a median indexed basis, Healthcare IT companies have almost doubled their value, with almost all growth coming from revenue and multiple expansion.

Compared to healthcare businesses, the median Healthcare IT company has lent slightly more on revenue growth to create value, but it is clear that in both their performance, and in how they generate that performance, Healthcare IT businesses have historically tended more towards their healthcare colleagues than their technology peers.

Read the full report today

Read the full report today