Blog

Carve-Outs Have Changed—But Opportunities Remain

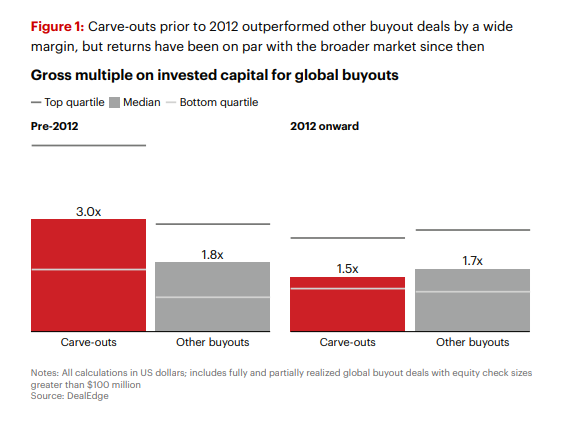

According to Bain & Company’s 2025 Global Private Equity Report, corporate carve-outs have long been a cornerstone of private equity investing. Historically, they outperformed other buyout deals, delivering an average 3.0x multiple on invested capital (MOIC) before 2012, compared to 1.8x for other buyouts.

However, Bain’s latest findings highlight that the carve-out advantage has narrowed. Since 2012, the median MOIC for carve-outs has fallen to 1.5x, slightly below the 1.7x average for other buyouts. Yet, top-quartile carve-outs still deliver strong results, averaging a 2.5x MOIC, compared to 2.7x for top-quartile buyouts.

“Top-quartile carve-outs continue to produce solid returns—a 2.5x MOIC vs. the 2.7x top-quartile buyout average.”

While competition and rising multiples have made execution more challenging, Bain’s research shows that the best PE firms are still achieving superior carve-out returns by evolving their approach.

Unlocking Value in Today’s Carve-Outs

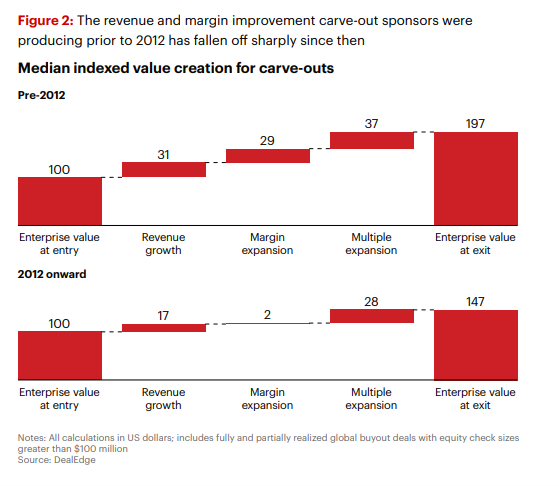

Bain’s report, supported by DealEdge data, finds that the declining performance of carve-outs is tied to a significant drop in operational improvements post-separation.

Before 2012, carve-out value creation relied heavily on revenue growth (+31%) and margin expansion (+29%). In recent years, these numbers have dropped to 17% revenue growth and just 2% margin expansion—a major shift in the value equation.

With higher acquisition prices and fewer immediate operational wins, according to Bain, the firms still winning in carve-outs are those that:

- Integrate value creation planning into separation execution from Day 1

- Make decisive leadership changes where necessary to accelerate transformation

- Align the carve-out’s go-forward strategy with its separation structure to avoid wasted time and effort

"Carve-outs often unlock hidden value, but they require more than just capital. Precision execution is key."

Rather than relying on traditional playbooks, Bain’s findings indicate that today’s best carve-out sponsors combine rapid stand-up execution with a laser-focused value-creation plan (VCP).

How to Analyze Carve-Outs on DealEdge:

If carve-outs are part of your strategy, having the right data at your fingertips is crucial. Follow these steps to build your own Carve-Out Report.

1. Log in to DealEdge -- Not a subscriber? Sign up for the Free Trial

2. Select “Explore Market Insights”

3. Select the Charts you care most about. We suggest: Returns, EBITDA Multiples, and the Value Creation Bridge

4. Click “Advanced Deal Filters” on the left-hand side

5. Under “Deal Source & Exit Routes,” select “Carve-out” from the Deal Source pick list

6. Add any other filters – Geography, Industry, Deal Entry Year

7. Click “Review Deals”

DealEdge’s carve-out benchmarks provide unmatched visibility into historical performance, risk factors, and value creation strategies.