What is the Fund Benchmark Service?

What is the Fund Benchmark Service?

Unlock unprecedented insights into your fund's performance with the most sophisticated benchmarking analysis in private equity. DealEdge’s asset-level approach goes beyond traditional “North American, Buyout” benchmarks to help you understand the effectiveness of your sector strategy or deal execution.

What is DealEdge?

What is DealEdge?

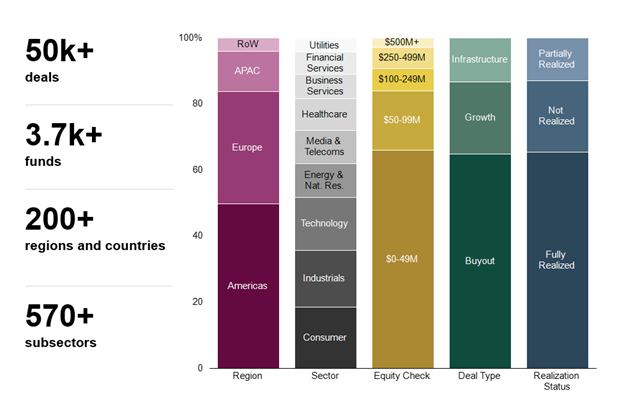

DealEdge is a private equity analytics platform from Bain & Company and CEPRES, offering unmatched transparency into sector-level performance. Powered by deal-level data from 50,000+ GP-sourced deals and mapped to Bain’s proprietary taxonomy, DealEdge enables precise performance comparison and sector insight.

What Makes DealEdge Fund Benchmarking Different

What Makes DealEdge Fund Benchmarking Different

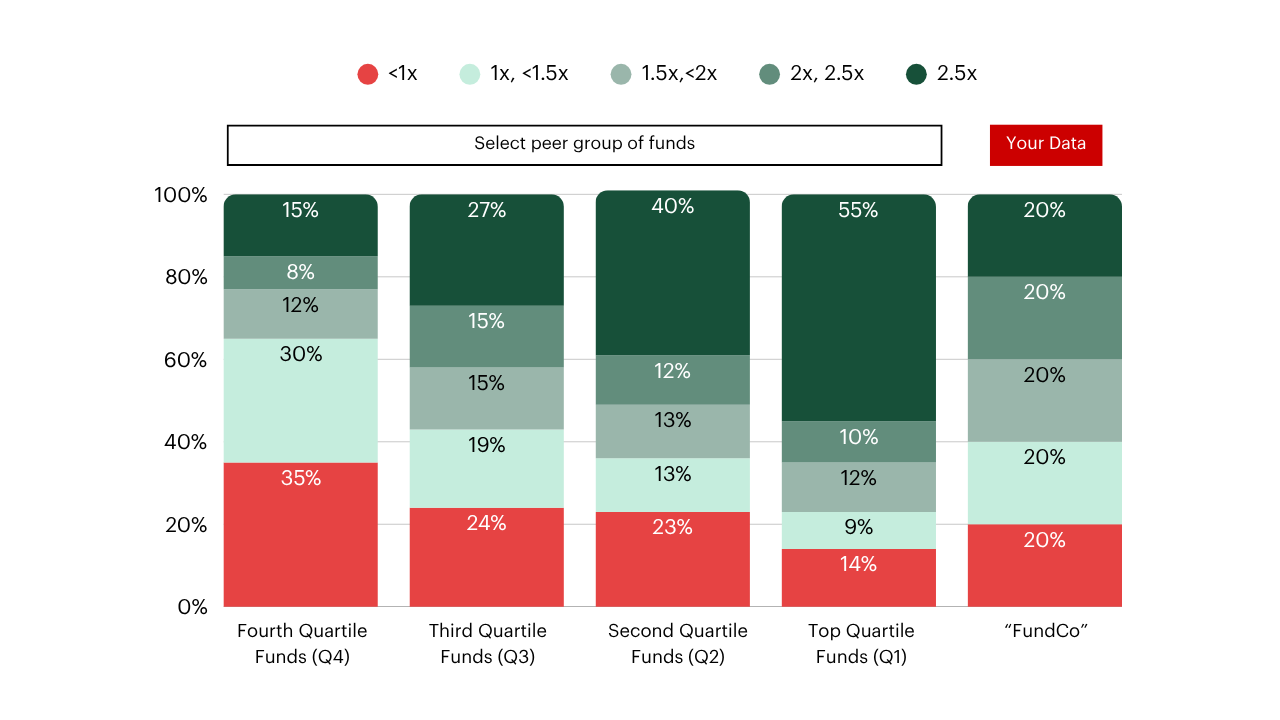

True Peer Benchmarking with the Fund Benchmark Chart

Traditional benchmarking can be misleading. One or two breakout deals can artificially inflate a fund's overall performance. Unlike one-size-fits-all comparisons, our Fund Benchmark chart empowers you to:

- Construct precise peer groups tailored to your investment/sector strategy

- Understand your fund distribution

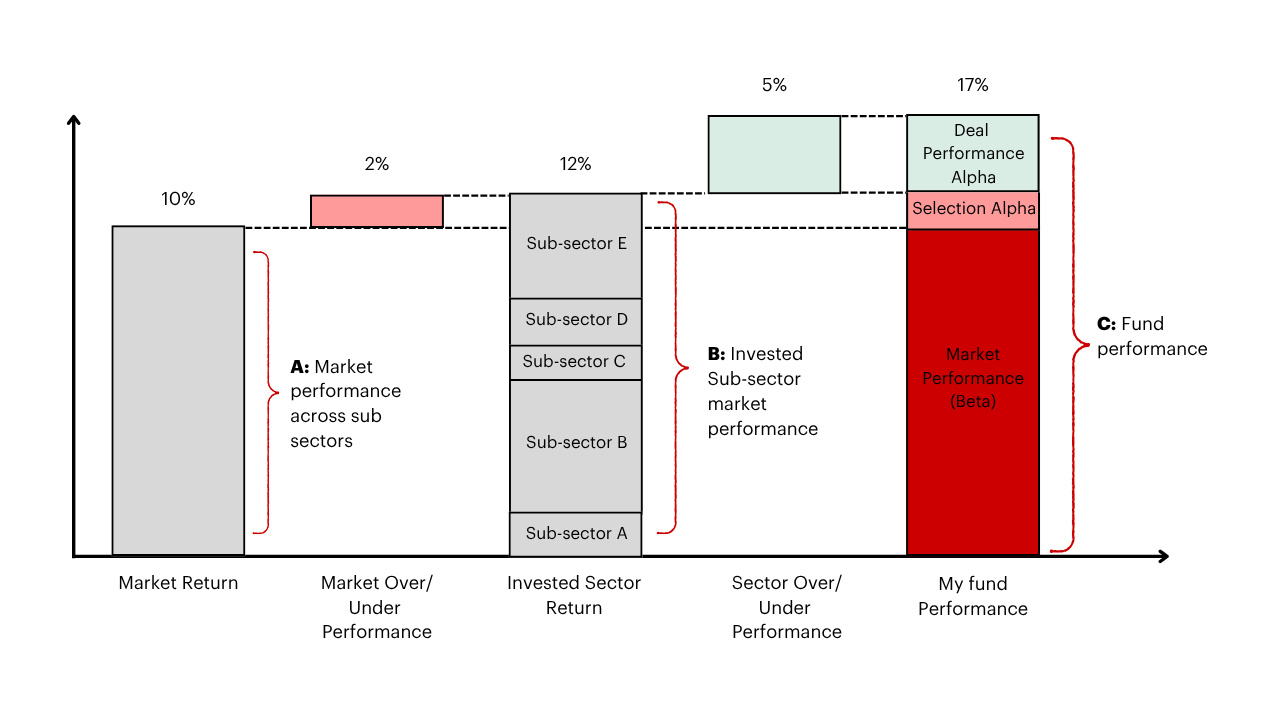

Deal Level Transparency with the Alpha Bridge Chart

The Alpha Bridge Chart shows if your fund's performance comes from picking good sectors or just riding the market. It:

- Breaks down performance by sub-sectors, not just overall fund

- Reveals if your returns stem from sector positioning or deal execution

This detailed analysis proves your investment expertise, not just market exposure.

How it Works

How it Works

After submitting your fund track record through a secure portal, our expert team will:

- Build your custom peer benchmark (Fund Benchmark Chart) OR conduct a granular deal-by-deal performance analysis (Alpha Bridge)

- Generate a detailed report in PowerPoint and EXCEL

- Offer guidance and support on story-lining the analysis for your LP communications, fund diligence, or internal benchmarking

Ready to Learn More?

Ready to Learn More?

Don’t leave your fund’s performance to guesswork. Fill out the form below to learn more about how we can help you benchmark your results and stay ahead of the competition.