Blog

Private Equity Value Creation Report

Download our analysis and see how top quartile private equity deals create value

Are You Standing Out to LPs?

In such a challenging fundraising environment, it’s more important than ever to differentiate your approach. Investors are focusing on strong value creation, and firms that want to secure capital need to be able to show their credentials in that regard.

Fund-level benchmarks cannot meet this need. They do not track the alpha generated by specific deals, and it is difficult to compare funds on a like-for-like basis. Deal-level benchmarks offer much more granularity: tracking value creation in specific deals lets firms benchmark the constituent parts of their portfolio against only the most relevant peers.

With deal-level operational analytics, you can stand out to investors and demonstrate where you have the competitive edge. Explore how to power up your fundraising pitch with DealEdge.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo

Investors are focusing on value creation

How DealEdge Helps

DealEdge’s unique operational data and analytics are backed by more than 38,000 private equity deals. The platform offers an unmatched ability to assess and demonstrate where you generate alpha:

- Examine how much alpha is generated in different market niches

- Benchmark your own value creation track record

- Assess and refine your forward-looking strategy

- Demonstrate to investors where you have a competitive edge

How is alpha generated in different market niches?

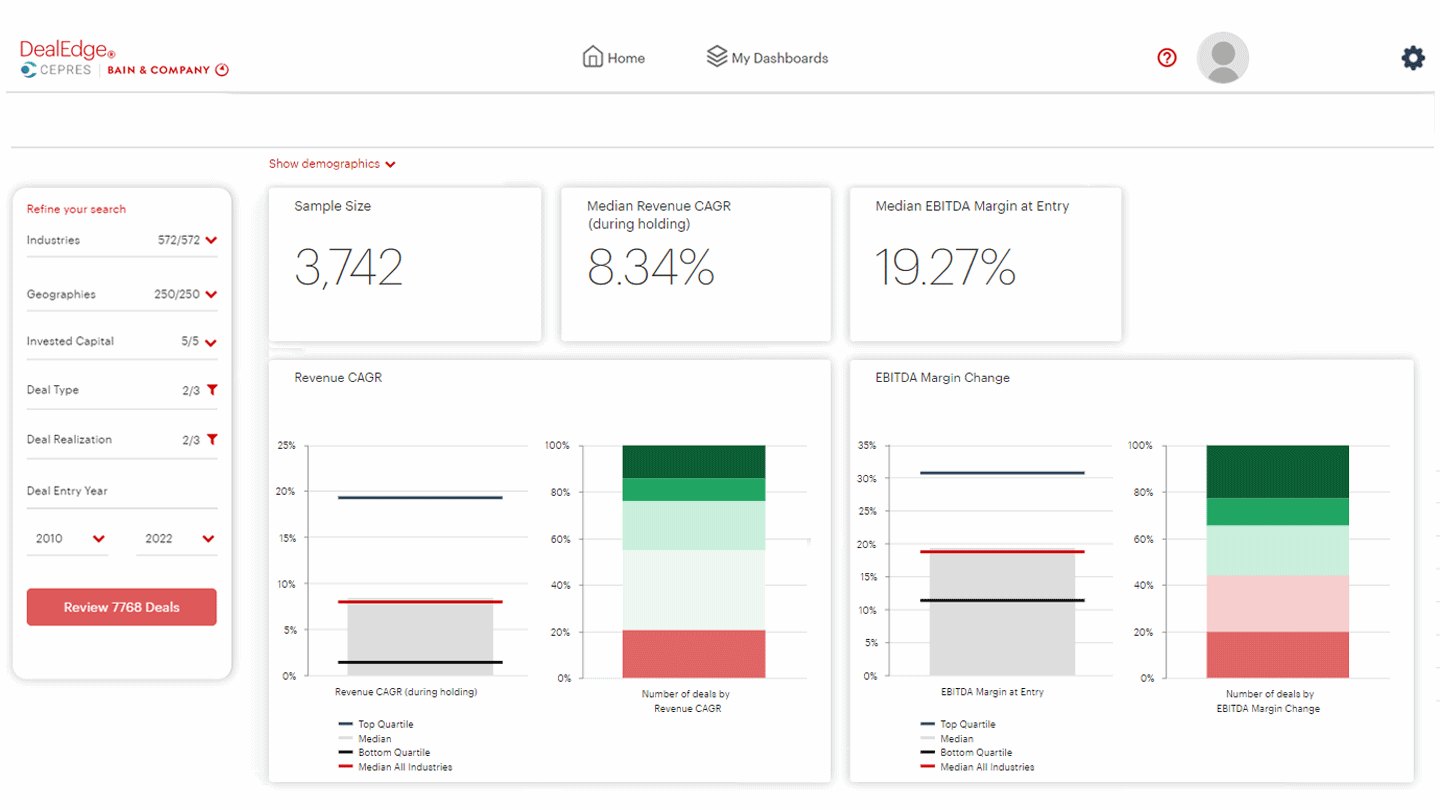

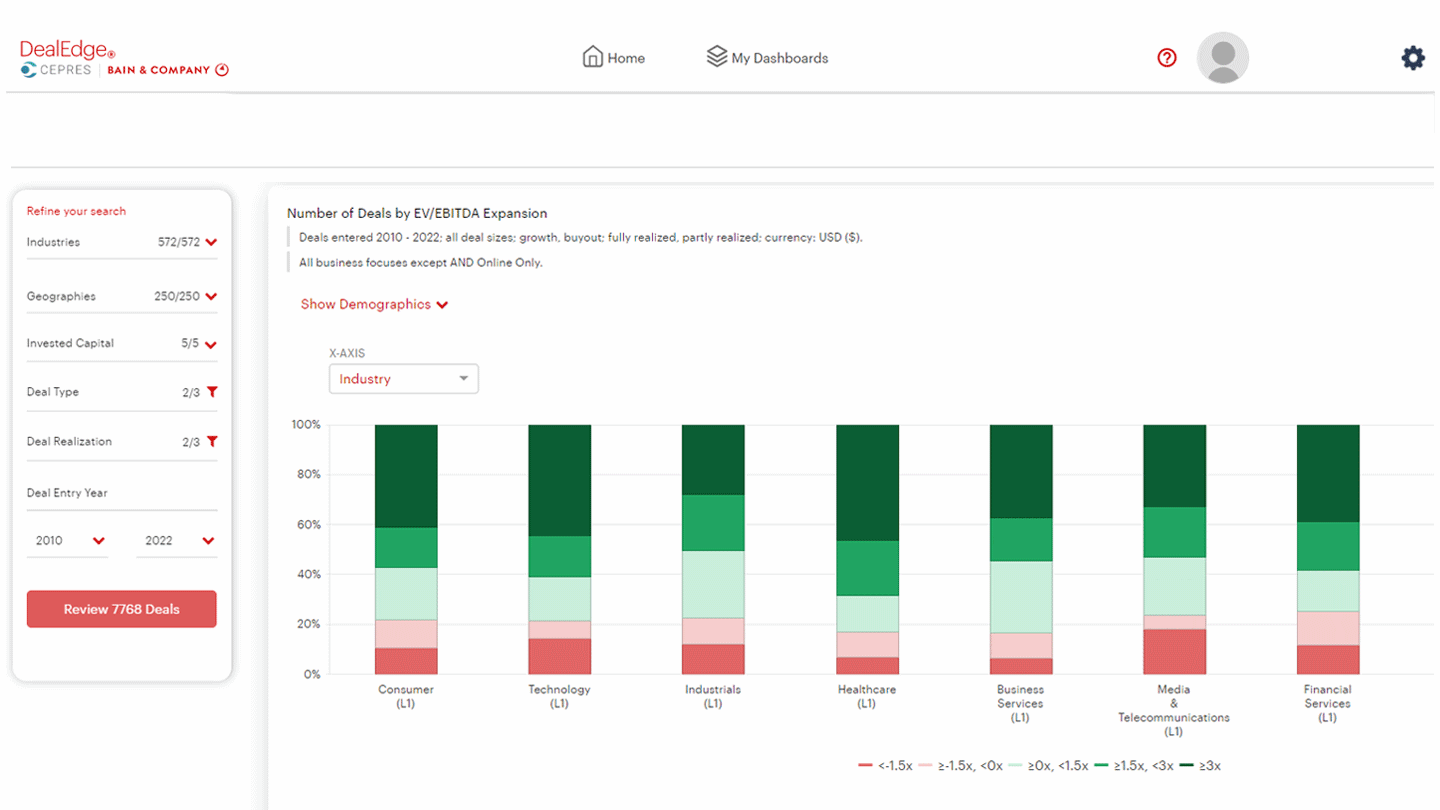

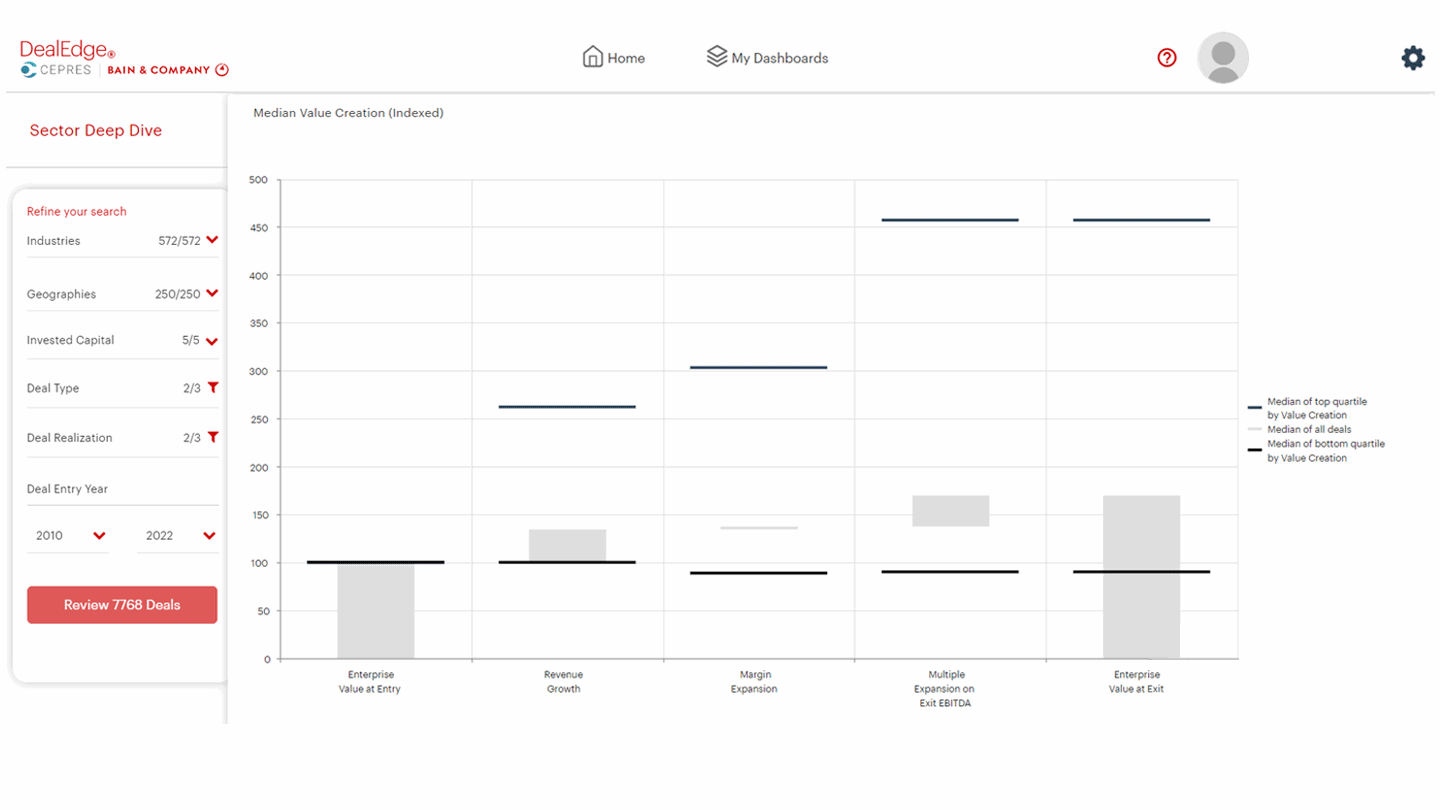

DealEdge’s value creation waterfall charts offer an at-a-glance analysis of how much value deals have created on both an indexed and a total-capital basis. It breaks down the different levers of value creation – revenue growth, margin expansion, and multiple expansion – to show clearly how successful portfolio companies have driven growth.

Search across more than 570 industry subsectors, and filter by investment year, deal size, region, and more to see only the deals that are most relevant to you. Identify pockets of opportunity that match your value creation strategy, or see whether successful deals in your area have relied on the same levers.

See across the investment landscape at a glance

How do I benchmark my track record?

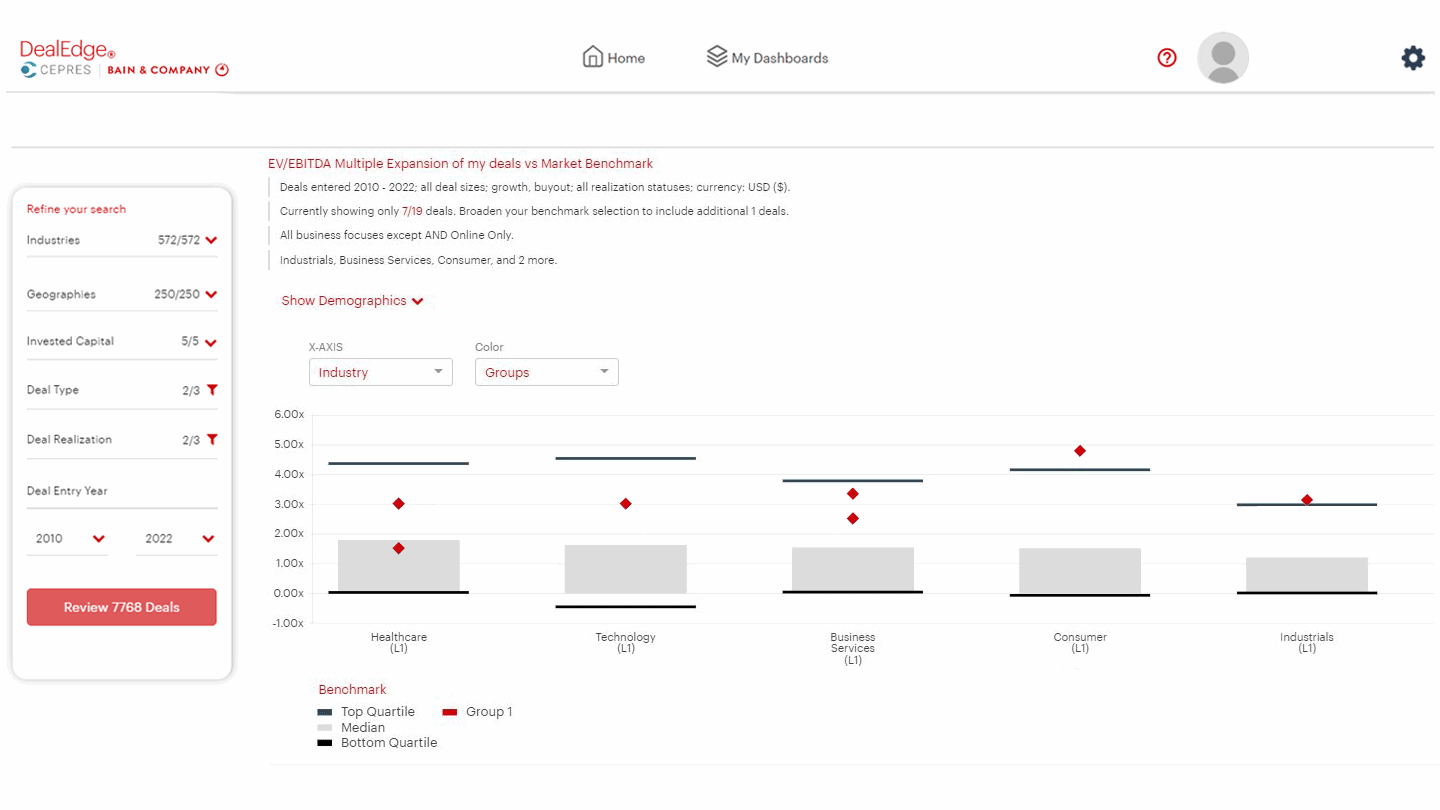

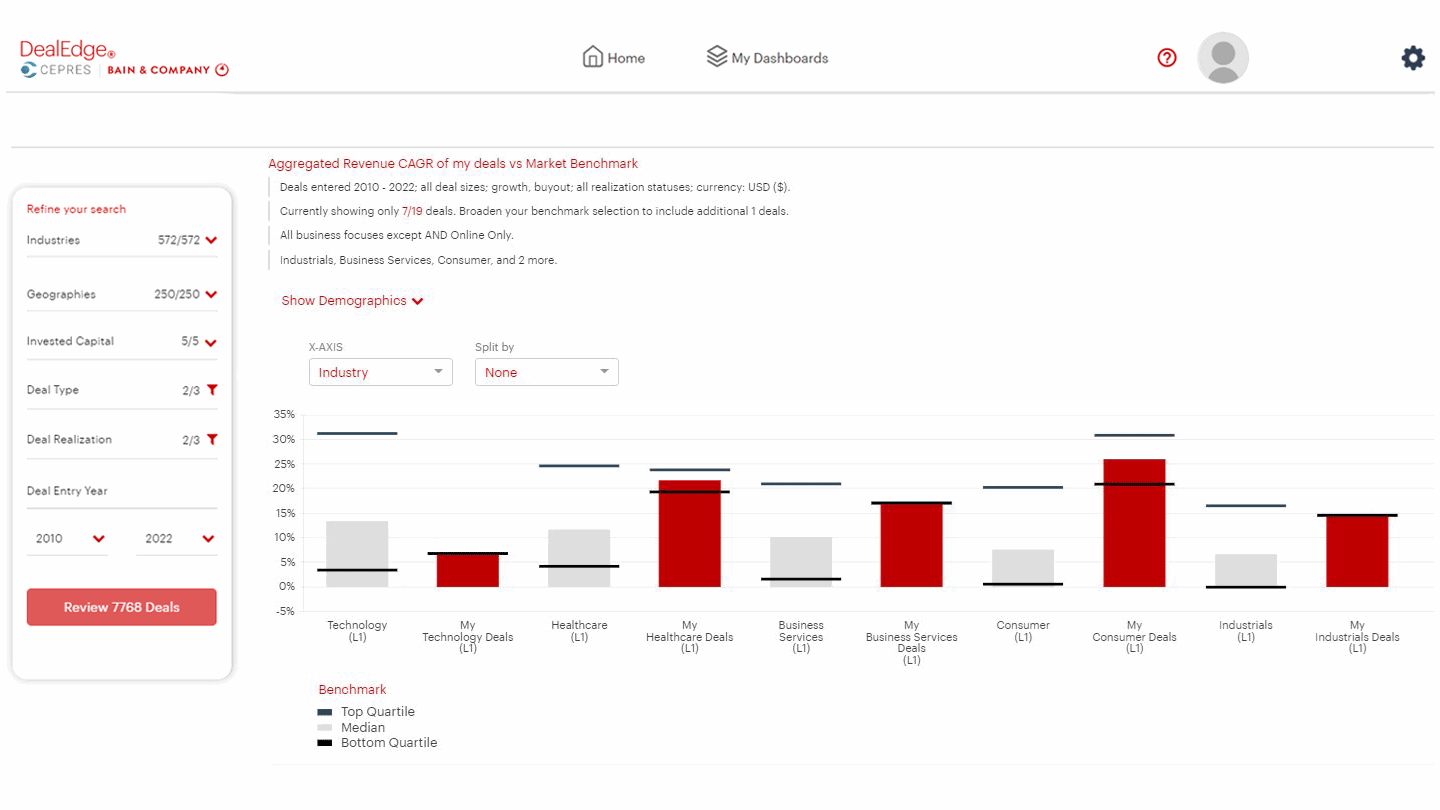

With DealEdge, you can benchmark your own operations outcomes side-by-side against sector-specific benchmarks. See where similar deals generate alpha, and where you have outperformed. DealEdge’s operational metrics include revenue CAGR, EBITDA margin change, and EV/EBITDA and EV/revenue multiple expansion.

Benchmark your data side-by-side with specific market comps

How do I refine my forward-looking strategy?

This deep assessment can also inform your forward-looking sector strategy. By exploring what approach allowed successful deals to generate alpha, you can test whether your strategy is optimized for your particular area of focus.

Refine your strategy to maximize your upside potential

How do I demonstrate my competitive edge?

Value creation analytics can instantly enhance any fundraising pitch. Benchmark your deals against highly relevant peers, and show exactly where you are generating outperforming alpha. Highlight the market niches which are generating strong alpha, and demonstrate how your strategy will maximize the potential of these areas of investment.

Highlight your competitive advantage

What it means for GPs

Comprehensive value creation analytics are a step-change for the private equity industry. For private equity leaders, they bring a new level of certainty when refining sector strategy. Benchmark your own existing portfolio to understand where you are outperforming, or refine your strategy in order to maximize your returns potential.

For investor relations professionals, value creation analysis is the most effective way to stand out to investors. It highlights your track record of generating alpha in good times and bad, and demonstrates that your approach will find uncorrelated value.

Value creation data has the ability to refine your strategy and enhance your fundraising pitch. Find out more about how DealEdge can help you today.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo

Read the full report today

Read the full report today