Blog

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

The median private equity firm spends 80% of its due diligence time on deals that it will not execute1. But without knowing how the deals that they passed on performed, investment professionals can’t ensure that they are operating at maximum efficiency and efficacy. DealEdge’s new Pipeline Analysis service solves this challenge, giving fund managers actionable insight into the efficiency of their deal pipeline and triaging processes.

Notes: Dummy data

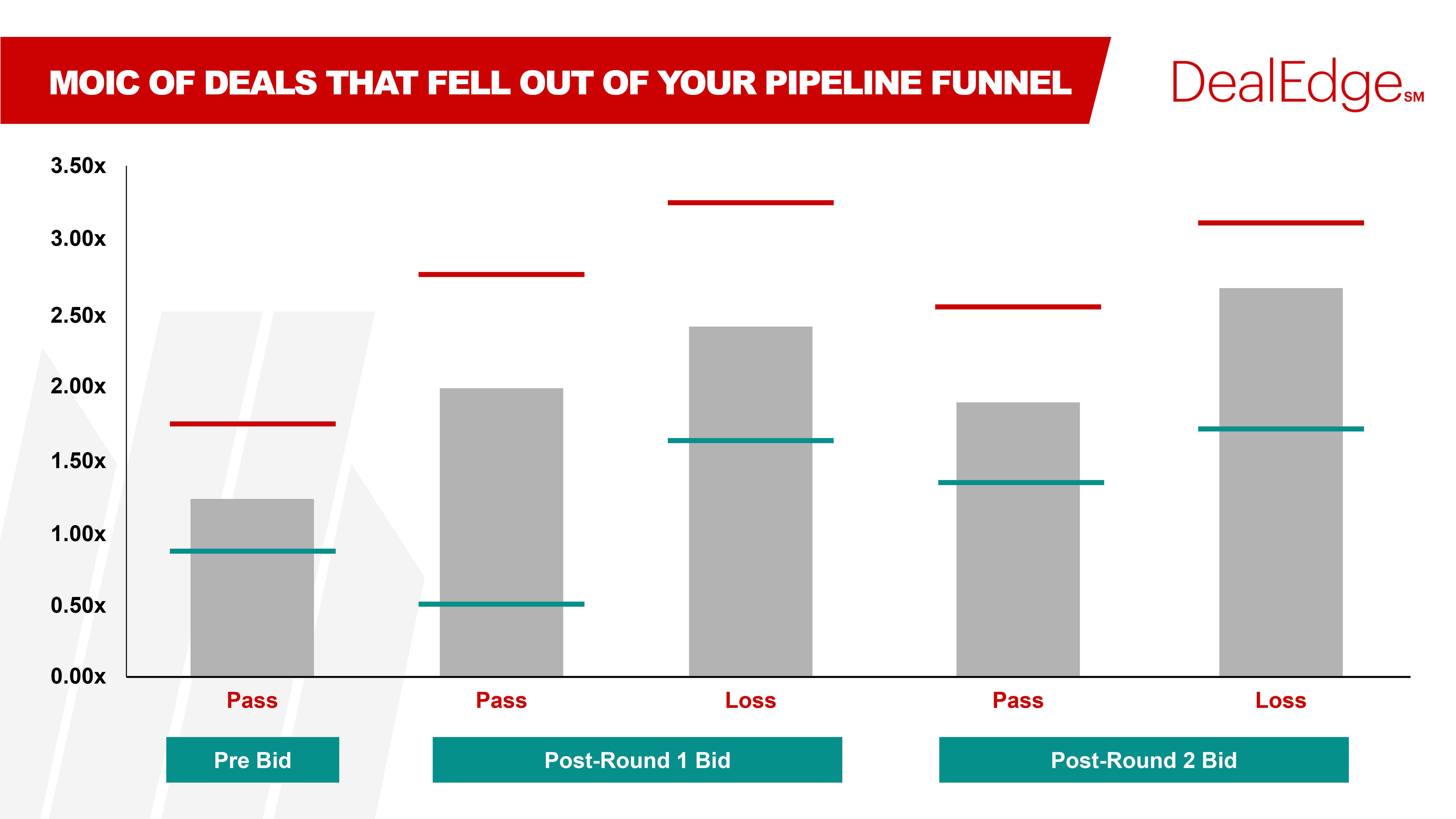

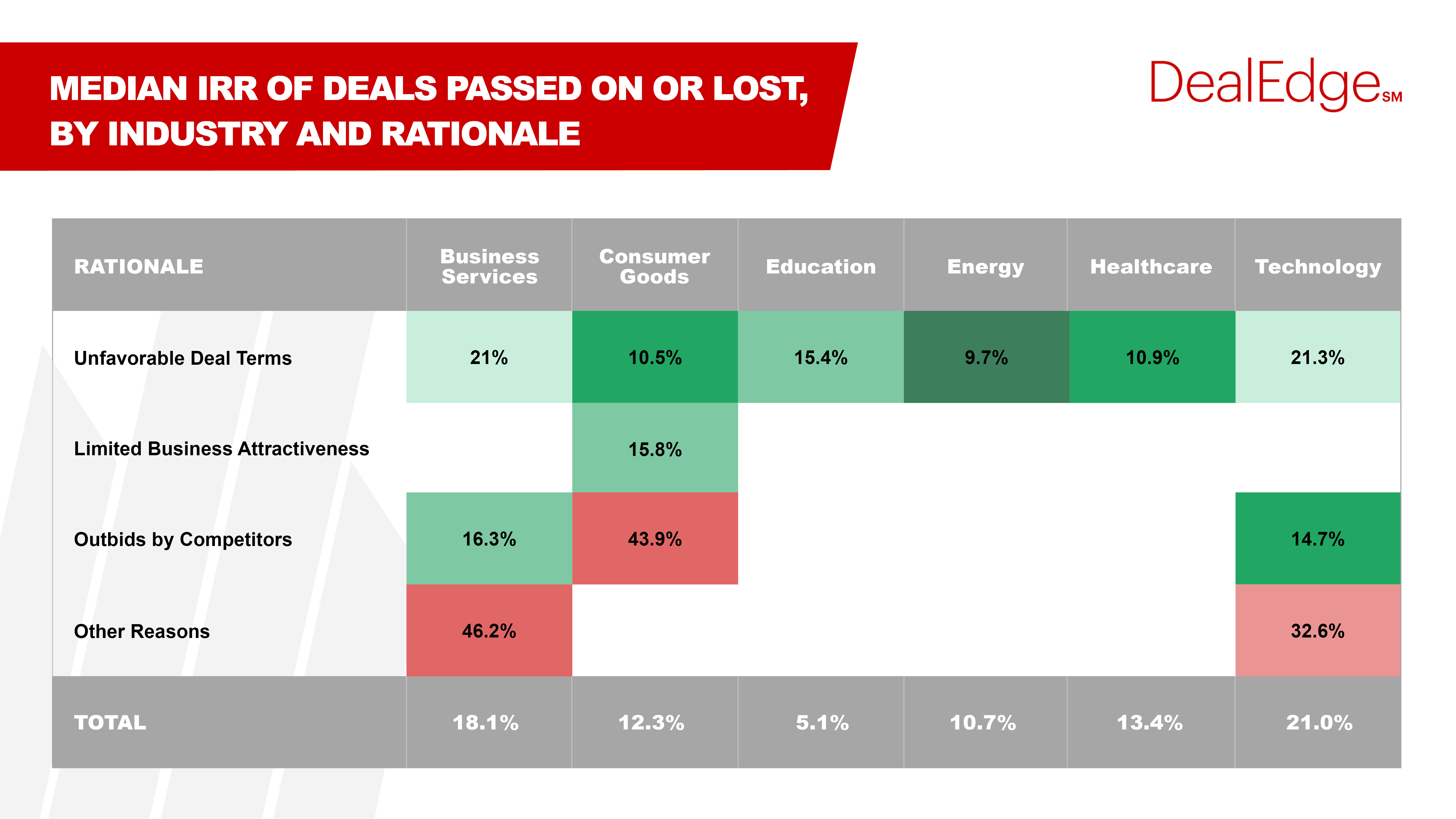

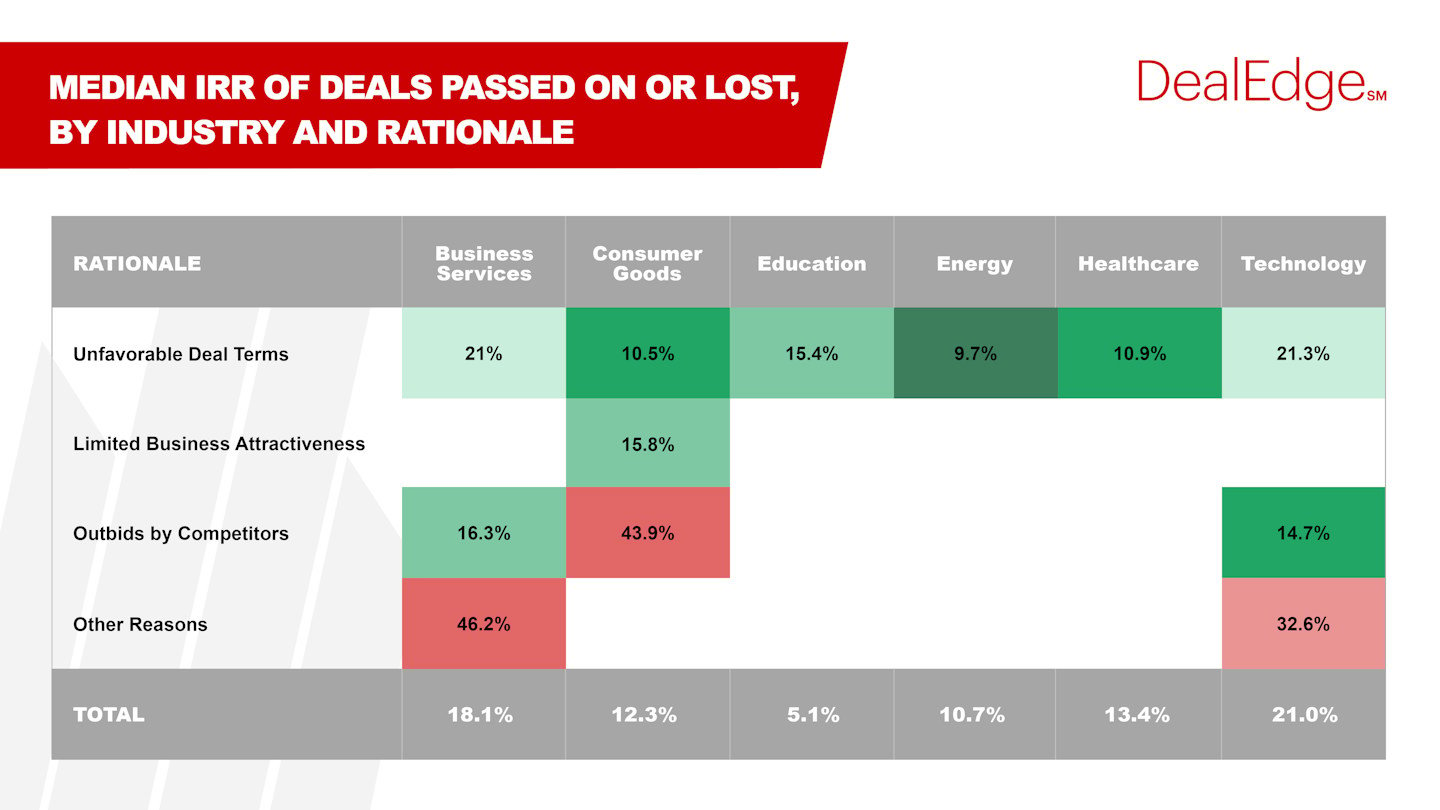

Source: DealEdgeDiscover whether you have been retaining the best performing opportunities at the top of your funnel. Pipeline Analysis lets you analyze the aggregated returns of deals that fell out of your funnel, whether you passed or were outbid. You can then compare these returns to the deals you did execute, to ensure that high performing deals aren’t being dismissed during your screening and due diligence processes.

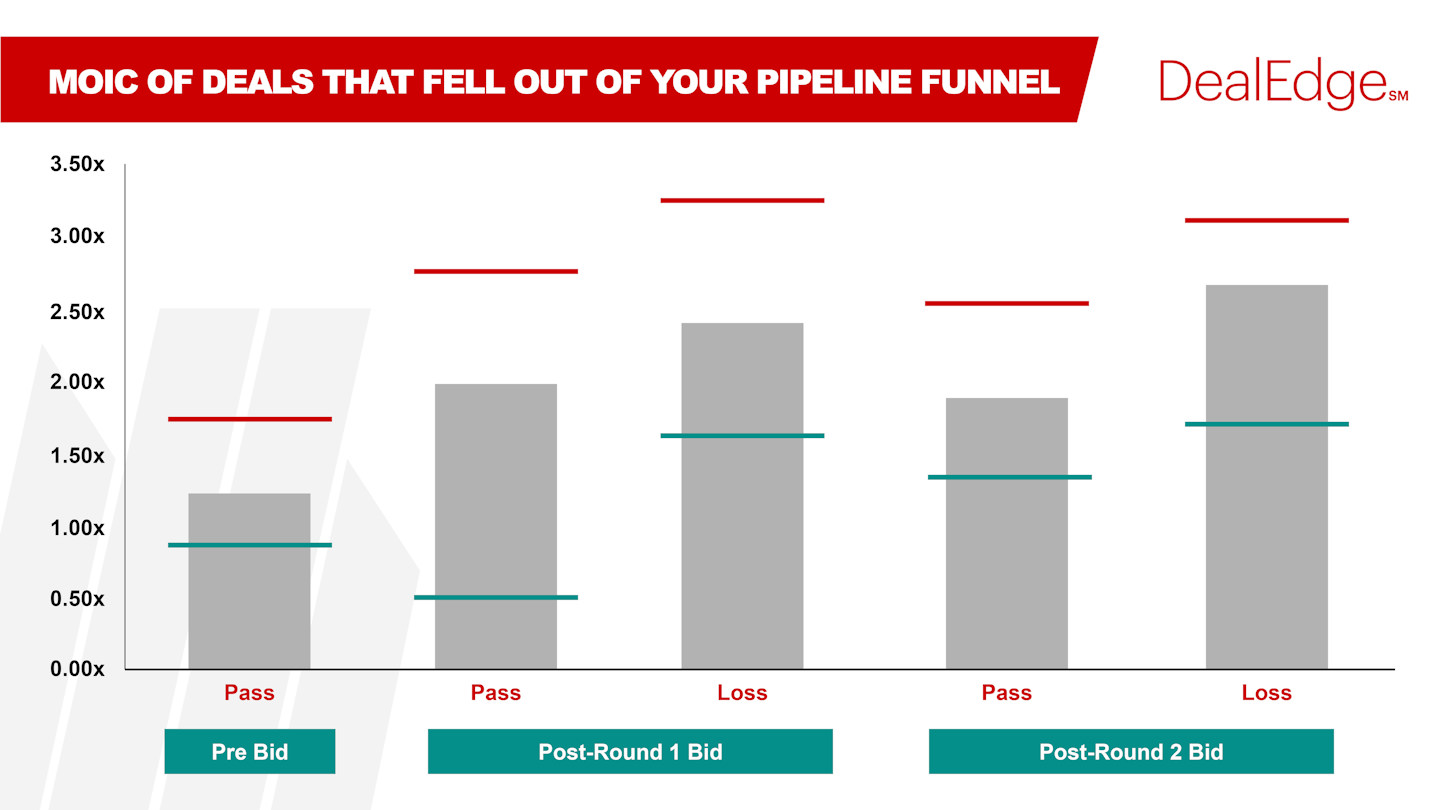

Segment your rejected deal opportunities based on the reason for passing on them, and see whether your assessment of the company or industry were accurate. Test whether those rejected deals bore out your reasoning, or whether you missed out on high performing deals.

Notes: Dummy data

Source: DealEdgeAssess your pricing strategy and discover whether you’re being outbid on high performing deals which deliver disproportionately outsized returns. Balancing the potential for overpaying with the prospect of underbidding against your competitors can be a difficult challenge. With Pipeline Analysis, you can compare the returns of lost opportunities with those of your executed deals, and examine the areas which have scope for stronger growth and higher bidding.

In such a competitive market, an efficient and contextualized deal pipeline and scoring process is a crucial competitive advantage for investment professionals. Make sure yours is flowing at maximum capacity with Pipeline Analysis from DealEdge. Speak to us today to find out more about how we can help.

Notes

- “Study: PE firms spend hours on investments they'll avoid”, Pensions & Investments, https://www.pionline.com/article/20110113/ONLINE/110119944/study-pe-firms-spend-hours-on-investments-they-ll-avoid