Report

Download the latest Sector Snapshot on North American technology private equity deals

Find the technology subsectors that are right for you

Find the technology subsectors that are right for you

The latest DealEdge Sector Snapshot explores how technology deals in North America have performed over the past decade, and how they have created value. It finds that:

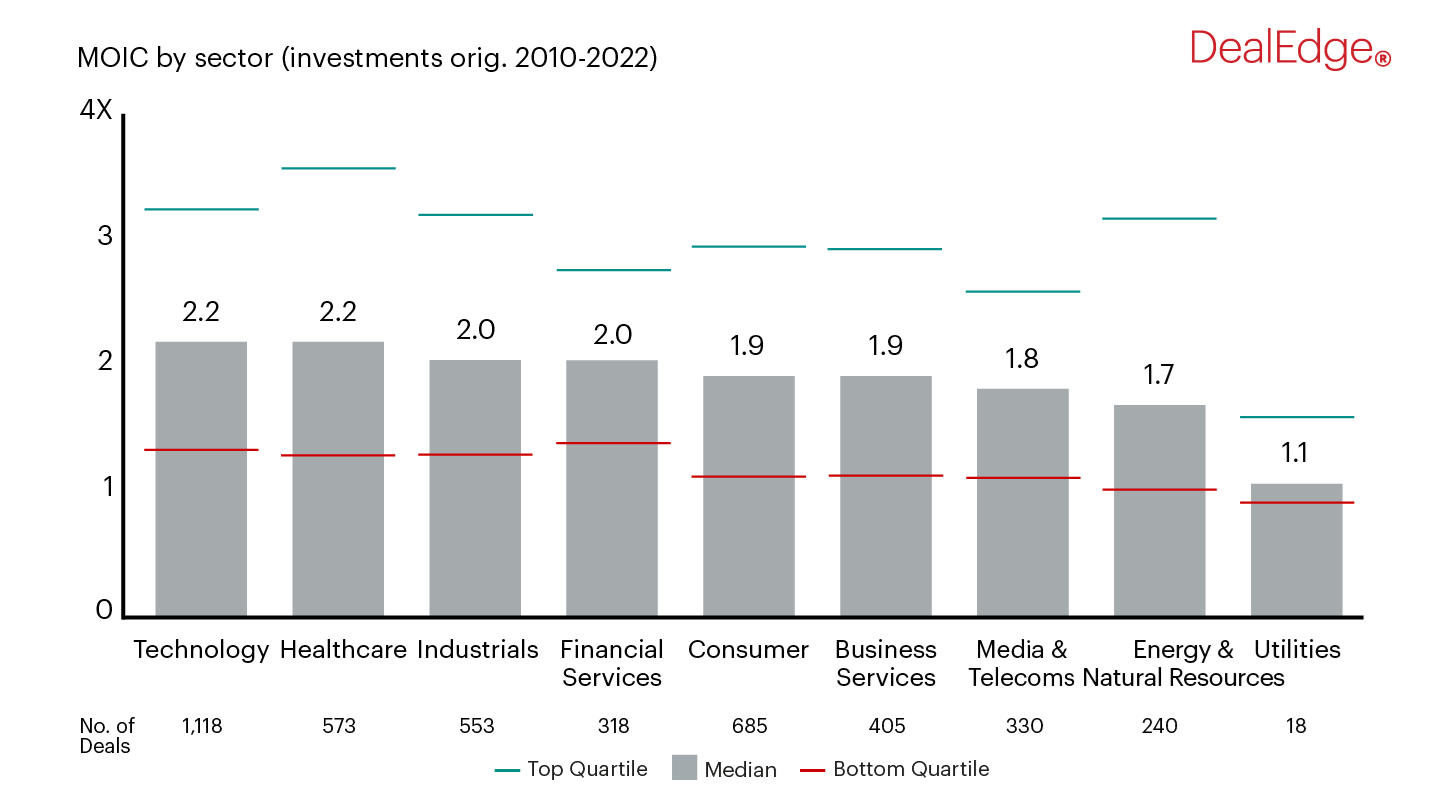

- Technology deals entered since 2010 have the highest median returns of any private equity sector, with a MOIC of 2.2X

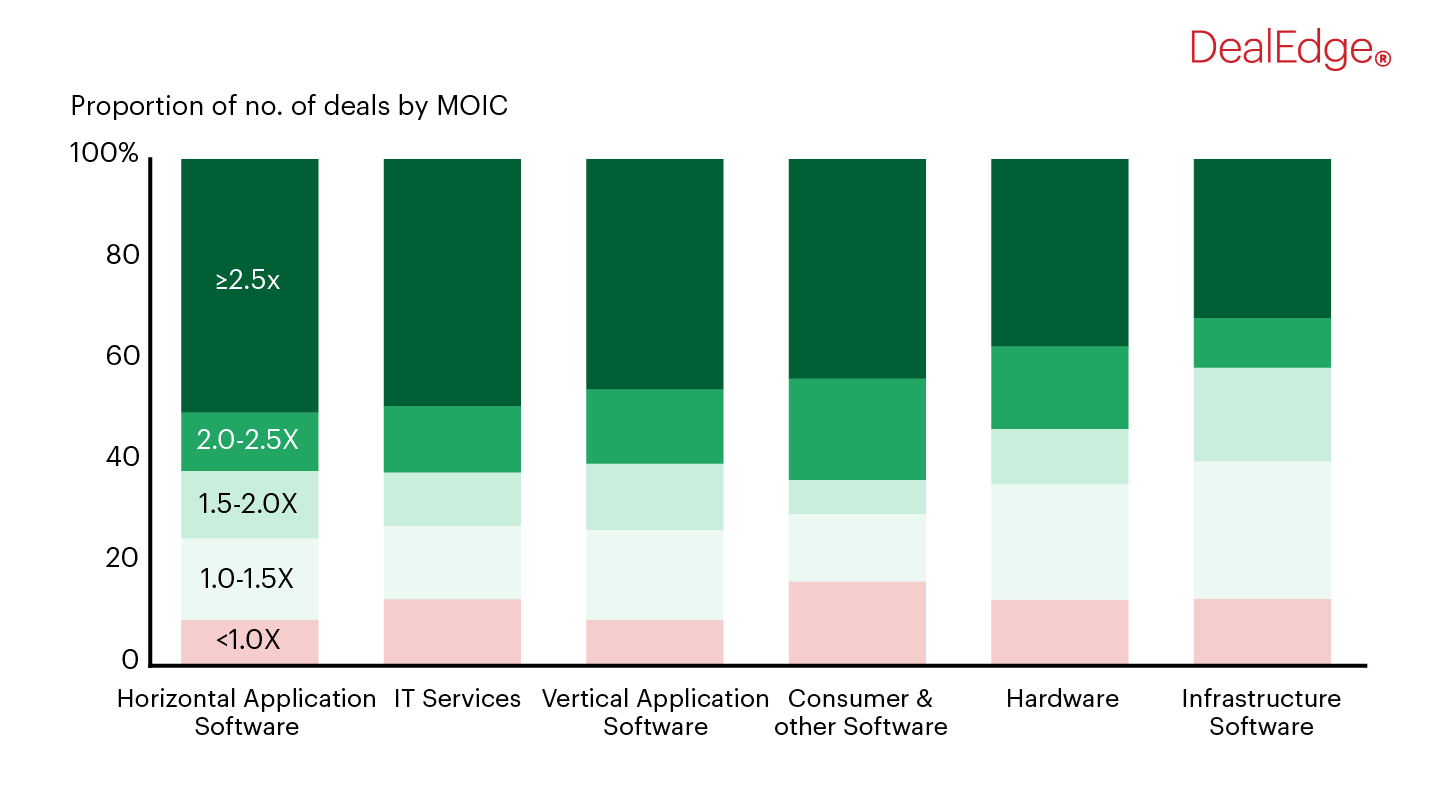

- Deals in different technology industries have widely varying performance and value creation profiles

- Deals in North America and Europe outperform the all-sector benchmark, but deal performance in Asia and Rest of World fell below the median all-sector benchmark

The Sector Snapshot demonstrates that in a broad and competitive space like technology, DealEdge’s granular insight on trends in different subsectors is vital for private equity firms looking to target exactly the areas where they can gain a competitive edge.

North American technology deals entered since 2010 have outperformed all other sectors

Half of Horizontal Software deals have a MOIC of more than 2.5X

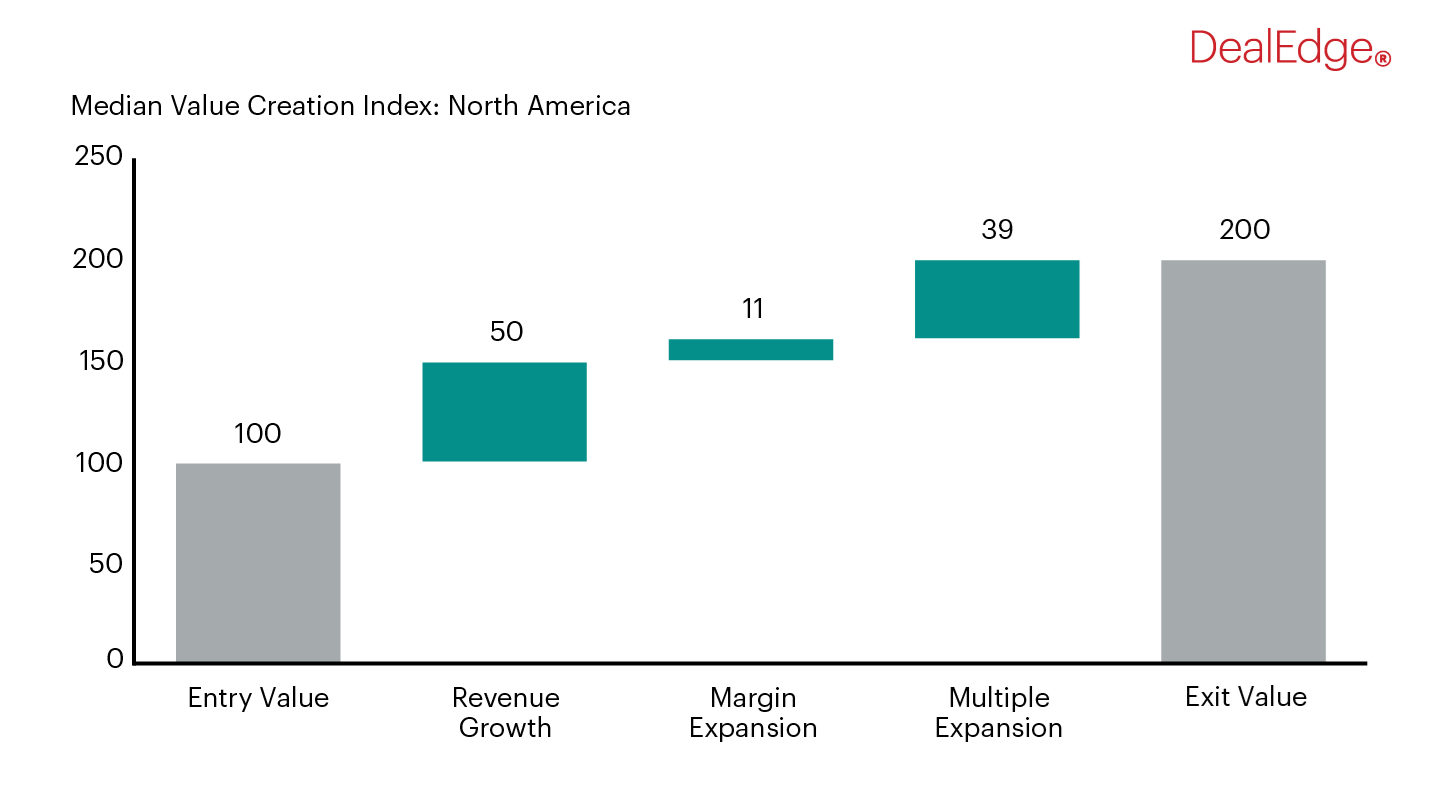

Technology deals in North America create value through revenue growth and multiple expansion

Want to see the breakdowns for Europe and APAC, or for specific target subsectors?

DealEdge at a glance

DealEdge at a glance

private market deals with performance and value creation data

sub-industries mapped to custom-built taxonomy

performance and operational analytics

DealEdge Sector Snapshot: North American Technology Deals

Get the latest private equity deal performance and value creation insights

Download Request demo