Blog

At a Glance

Deal-level performance benchmarks are driving data-driven decision-making across the private equity investment lifecycle. By incorporating them into your existing workflows, you can:

- Show LPs where you’ve outperformed during fundraising

- Screen deal opportunities more quickly and confidently

- Refine your sector strategy with a deeper layer of insight

“What do strong returns look like in my target sector? How does my performance really compare?”

For years, private equity GPs have had to rely upon either fund-level performance benchmarks or patchy deal returns data to understand how they measure up.

Now, for the first time, consistent, reliable PE deal-level performance benchmarks are available to the industry, bringing with them a new layer of actionable insight.

We’re excited to share a selection of these returns benchmarks with you through our first ever DealEdge Data Book: 2021 Private Equity Deal Performance Benchmarks report.

To make sure you get the most out of these benchmarks, here are three ways GPs are already incorporating them into their processes:

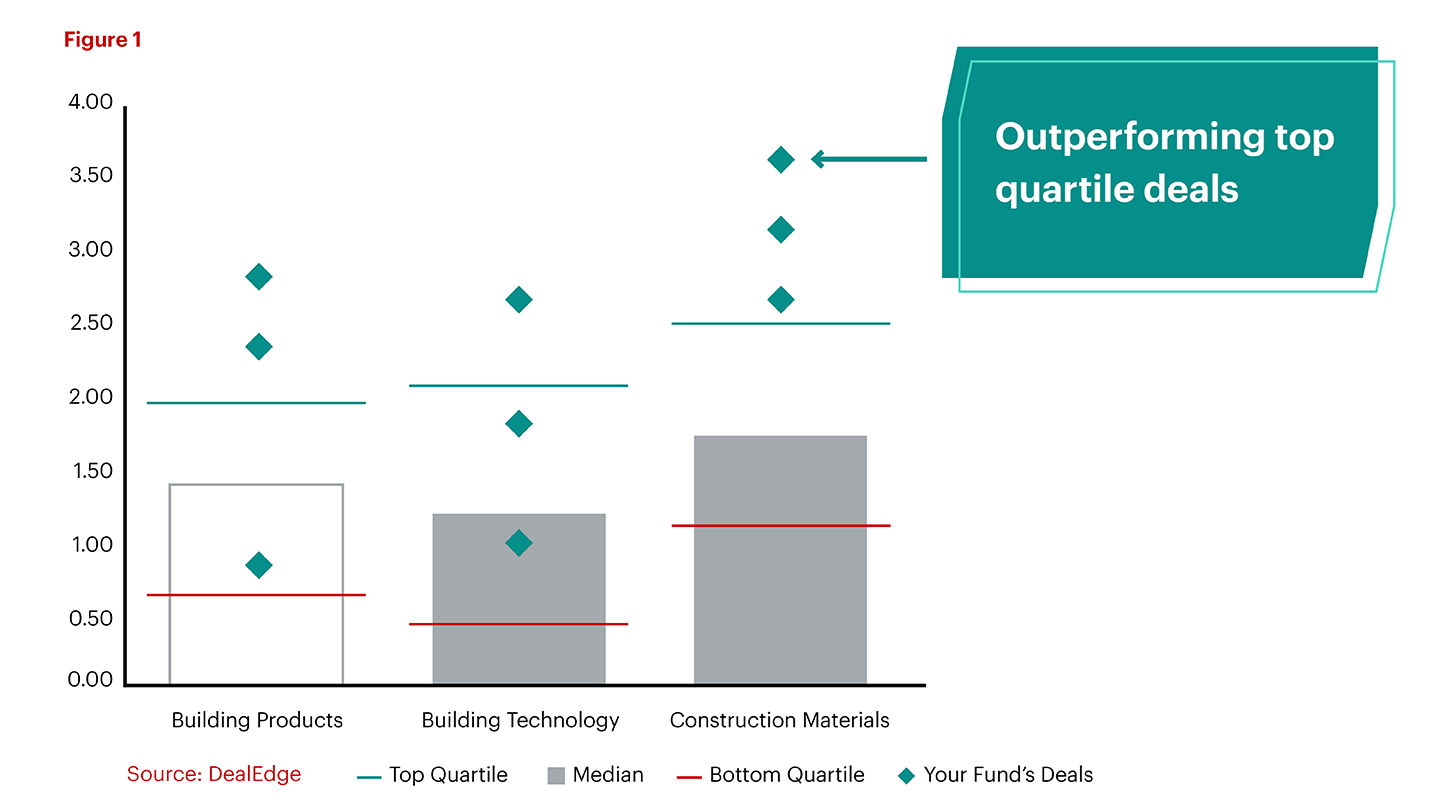

1. Show LPs where you’ve outperformed

Just as GPs are more data-driven than ever, so are LPs. They need the deepest possible insight on potential investments when receiving fundraising pitches.

This insight has previously been limited to what can be gleaned from fund-level performance benchmarks. But funds typically consist of multiple investments across various subsectors, geographies and entry years. Creating a relevant and meaningful peer group can be all but impossible.

Deal performance benchmarks, however, present a new opportunity for investor relations professionals seeking to showcase how their firm has outperformed.

Show where you excel on a deal-by-deal basis

Compare executed deals against comparable sector-specific peer groups across different investment years and geographies, and tell your firm’s story to LPs in richer detail than ever before:

- Highlight winning deals, not just funds

- Showcase which investments are driving a fund’s returns

- Demonstrate your track record across multiple industry subsectors

To leverage deal benchmarks in your communications, simply integrate the relevant sector benchmarks into your existing reporting. With deal benchmarks available to offer impartial and compelling context, your firm’s achievements can shine through more clearly than ever.

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

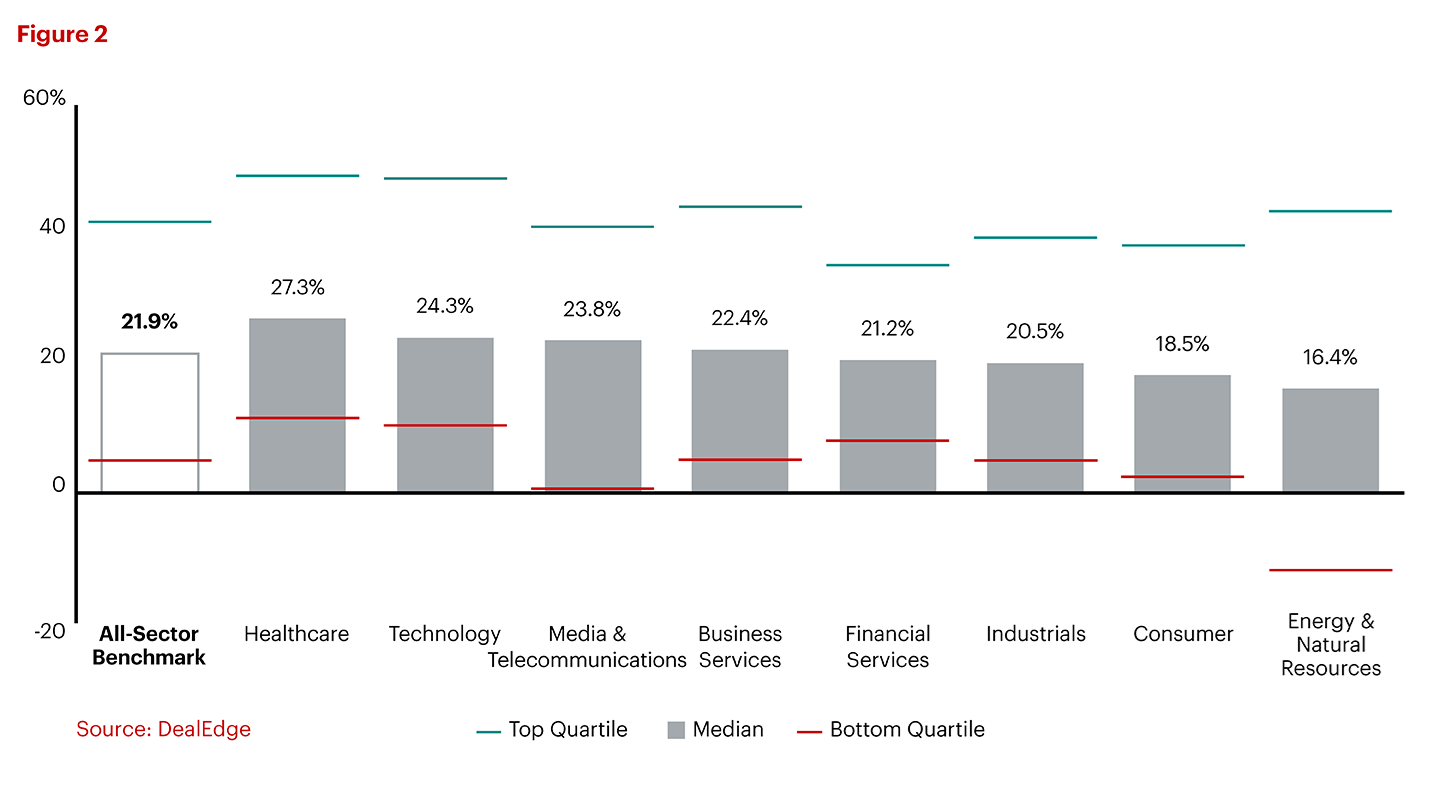

2. Screen deal opportunities more quickly and confidently

In such a competitive deal environment, investment professionals are reviewing more potential deals than ever before.

A data-driven approach during early screening can be critical in quickly identifying potential winners from among the wider pool.

With deal-level performance benchmarks, industry professionals can see the returns that private equity has historically generated in investments in similar businesses, and can easily identify those that are worth progressing to the next stage of due diligence.

For an even deeper dive, DealEdge’s platform gives you comparison points across more than 20 performance and value creation metrics.

Get at-a-glance insight on returns in specific subsectors

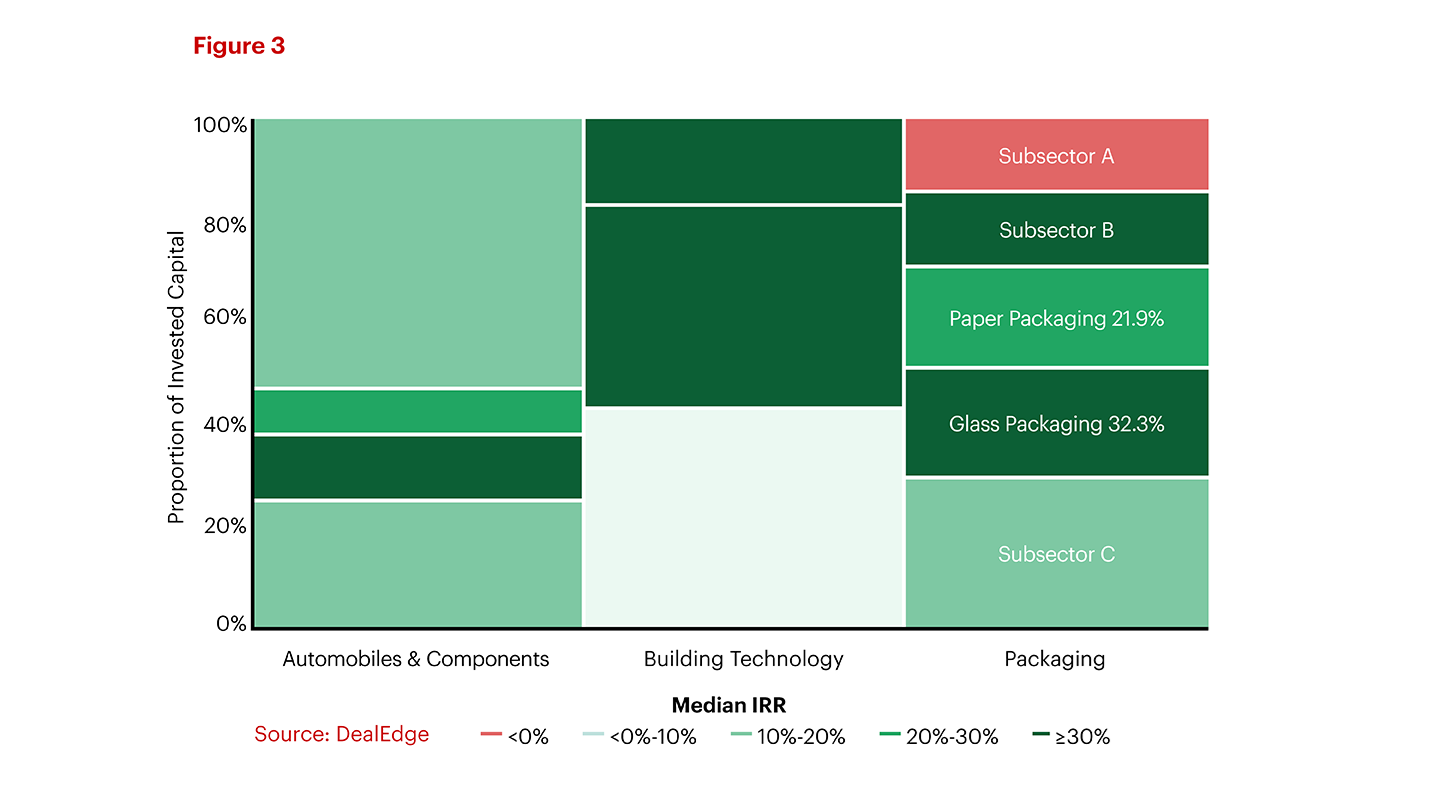

3. Refine your sector strategy

A carefully calibrated sector strategy is more important than ever. Deal-level performance benchmarks unlock new sector insights to help refine your sector strategy.

The added context and detailed insight from deal performance data enables investment professionals to clearly see where value can be found in the landscape, and to home in on those attractive areas.

See how returns have looked across industries and identify constituent subsectors with attractive return profiles. Select from among more than 560 subsectors and extract deeper insight from the data with DealEdge’s range of interactive charts.

Get deep insight into how industry subsectors compare

Access deal returns benchmarks today

Deal-level performance benchmarks are the next frontier of private equity intelligence, and GPs are already starting to use them to make better data-driven decisions and achieve outsized returns.

Explore our free DealEdge Data Book: 2021 Private Equity Deal Performance Benchmarks report to put a selection of our benchmarks to work straight away.

And if you’d like a closer look at the thousands of more granular benchmarks on DealEdge, then get in touch with us and we’d be happy to show you the platform.

DealEdge Data Book: 2021 Private Equity Deal Benchmarks

Get the latest deal-level performance insight

Download your copy Request a demo