Blog

At a Glance

Get smarter portfolio performance analysis. By combining your investments’ performance and operations data with sector-specific deal-level benchmarks, DealEdge helps you to:

- Refine your strategy with in-depth analysis of the investment landscape, and how your deals compare

- Optimize your investment process by strategically monitoring your portfolio versus industry performance

- Tell your firm’s story by demonstrating where you’ve outperformed the market and where you’ll find value with your sector strategy

A new layer of insight

Portfolio Diagnostics from DealEdge lets you dissect your portfolio to identify strengths and weaknesses in order to make the best possible strategic decisions.

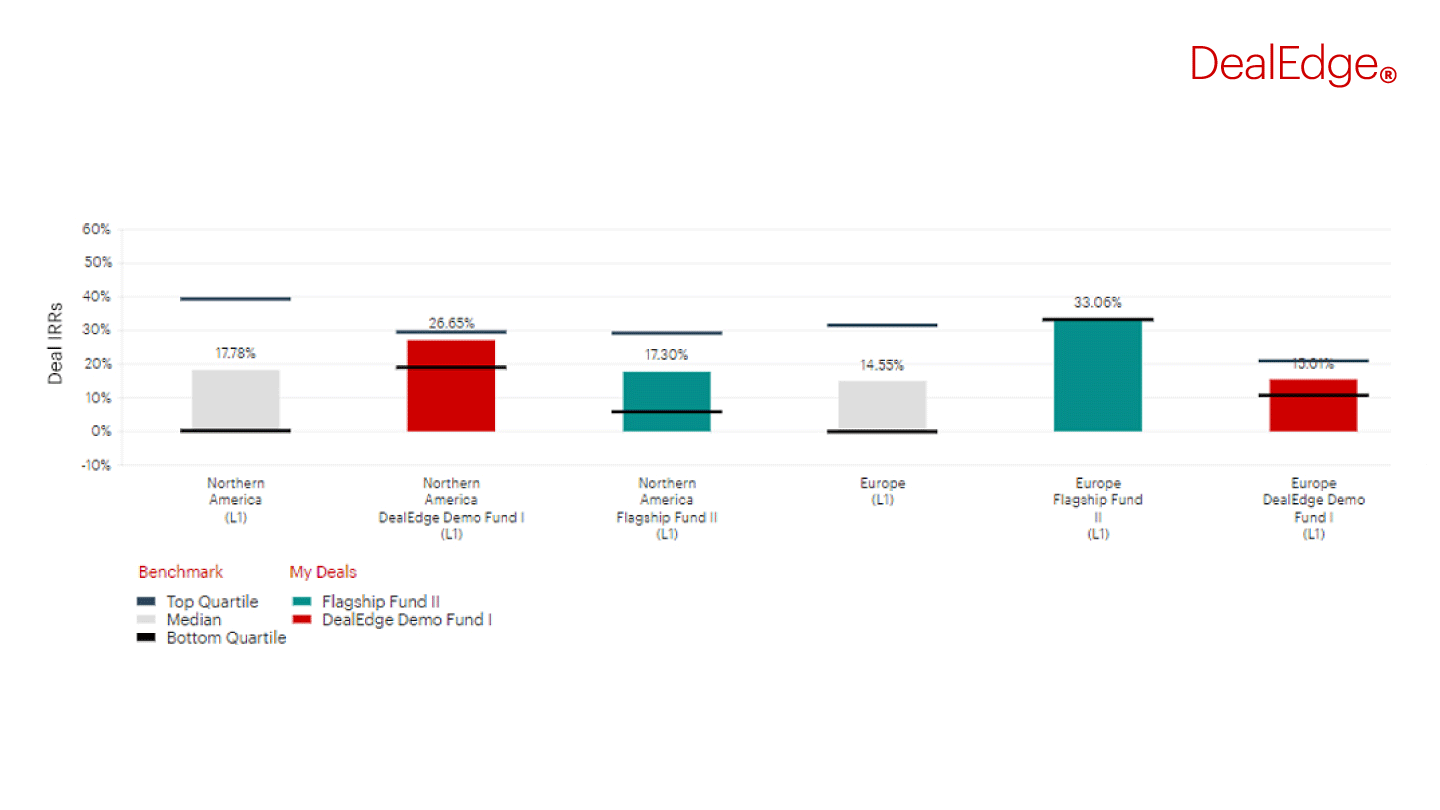

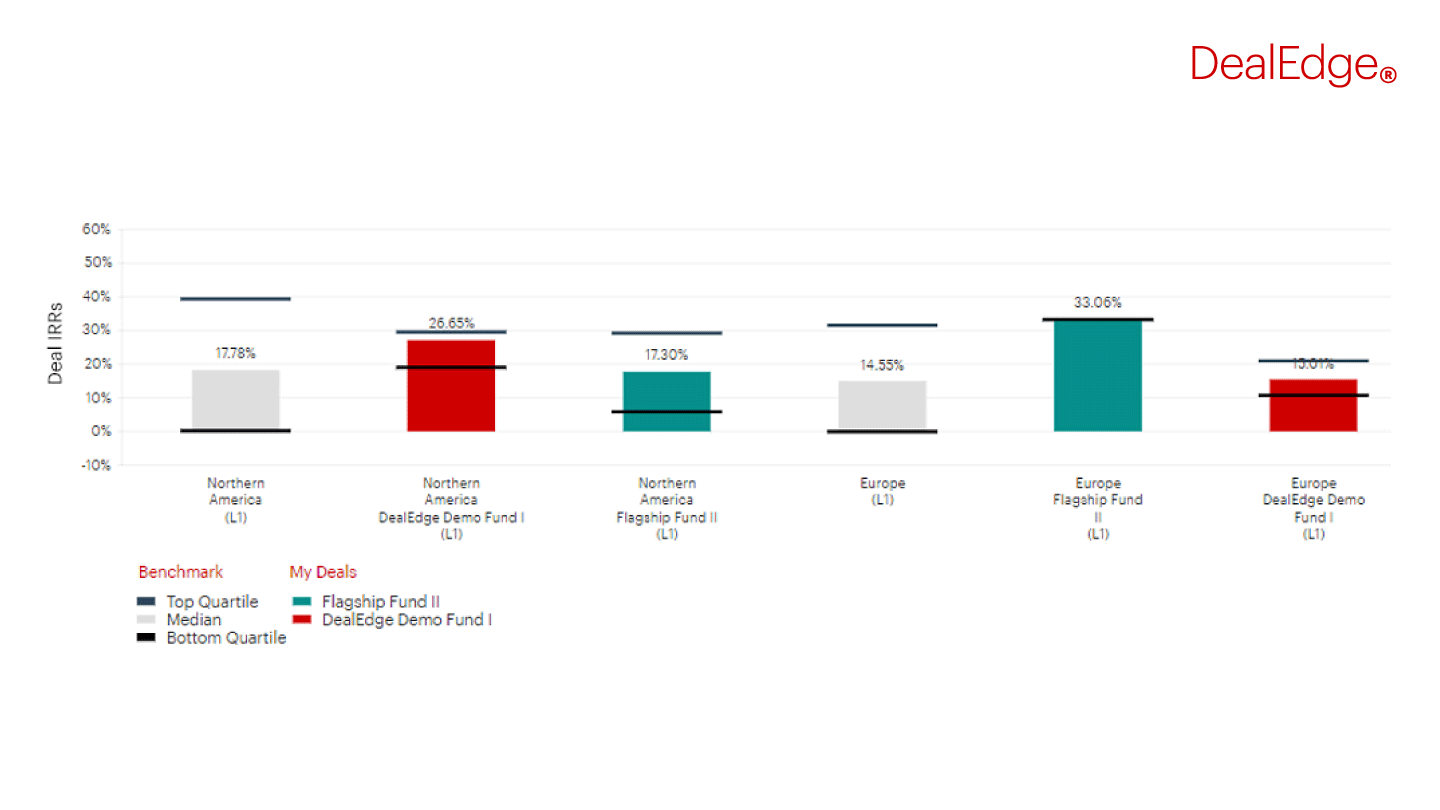

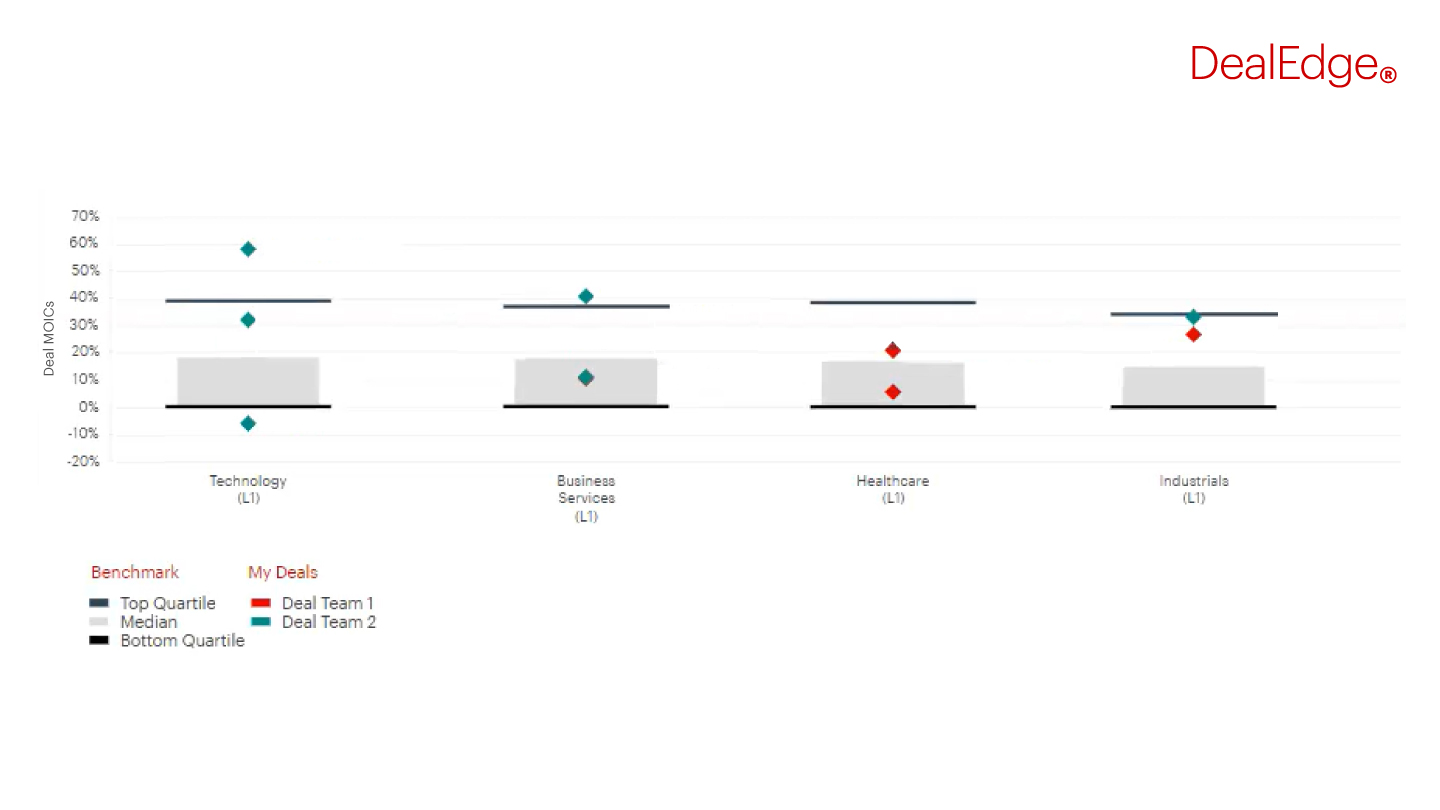

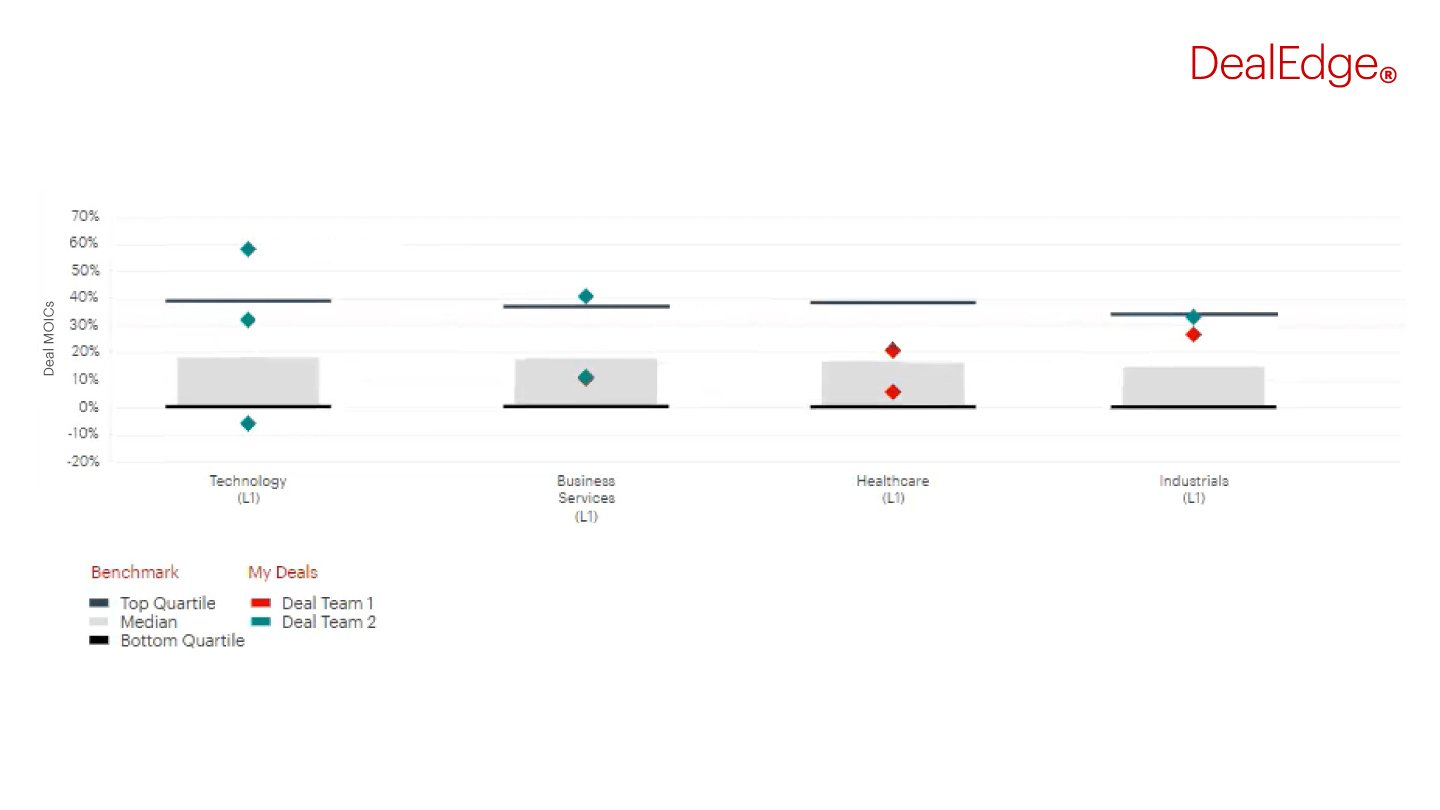

Portfolio performance analysis used to take considerable time and effort to compile, and relied on patchy, inconsistent industry data. Now, for the first time, you can see your investments’ deal-level performance and operations data side-by-side with relevant, accurate sector-specific deal benchmarks like IRR, MOIC and CAGR, based on data for 36K+ transactions mapped against 560+ subsectors.

With analytics based on tried-and-tested methodologies utilized by Bain & Company, DealEdge allows you to extract actionable portfolio performance insights to refine your strategy, optimize your investment process, and tell your story to LPs.

Sign up to DealEdge insights

Register your details to receive DealEdge insights, analysis and updates directly to your inbox

The answers you need

DealEdge’s expert-built analytics deliver immediate insight to help you maximize your performance potential.

Refine your strategy:

- The most granular map of the investment landscape available anywhere. By cutting through the imprecision of fund-level data, you can see how even closely related subsectors are performing compared to one another.

- Your portfolio performance plotted against highly relevant benchmarks. Identify whether you under or overperform in different subsectors or regions. Compare returns across your different investment teams. Assess whether you are playing to your strengths, and find untapped areas of opportunity.

Optimize your investment process:

- A single source of truth. By combining your own portfolio data with best-in-class deal-level analytics, your entire firm can leverage actionable intelligence using DealEdge.

- Live integrated performance dashboards. Strategically monitor your portfolio’s performance versus the market. Access the deepest possible insight into how value was created for portfolio companies like yours, and see what it takes to win.

Tell your firm’s story:

- Deeper, more accurate portfolio benchmarking. Making time-poor LPs take notice is becoming a defining challenge for investor relations professionals. DealEdge allows you to clearly demonstrate where you’ve outperformed on a like-for-like basis, giving you the edge over the competition.

- Sector-specific returns and value creation insights. Demonstrate where you’ll find value with your sector strategy. DealEdge makes it easy to build compelling pitches that show investors how you will generate winning returns.

How it works

DealEdge is designed to deliver actionable intelligence from the very beginning.

Market analysis:

- The platform has expert-built analytics covering more than 20 performance and operations metrics including IRRs, MOICs, CAGRs, EV/EBITDA multiples, risk factors, and more.

- With no implementation or data interpretation needed, you can cut straight to the answers you need across the market niches you are targeting.

Portfolio performance analysis:

- To integrate your own data with DealEdge’s benchmarks, simply securely upload your portfolio cashflow data to DealEdge. We can help you with the data import if required.

- Once uploaded, we automatically match your deals against relevant peer groups based on Bain & Company’s private equity industry taxonomy. You can also match to custom benchmarks you create.

- Data only needs to be uploaded once, and is instantly available across all regions and use cases. You control who can edit and view the information across your team.

Explore the platform

Explore the platform

To find out more about the latest update from DealEdge, or to see for yourself how integrated deal-level benchmarking can power your strategic decision-making, get in touch with us today to arrange a demo.