Blog

Having focused heavily on deal origination and execution over the past 12 months, many private equity firms are using the new year to review and calibrate their sector strategy to ensure they are positioned to maximize returns and take advantage of the opportunities offered post-COVID.

Refining a fund strategy has historically been a resource-intensive process. Private equity firms have historically not had access to consistent and comprehensive deal-level performance data, making it impossible to accurately benchmark businesses against their specific subsectors. Instead, firms have been forced to rely on qualitative data or anecdotal evidence alone.

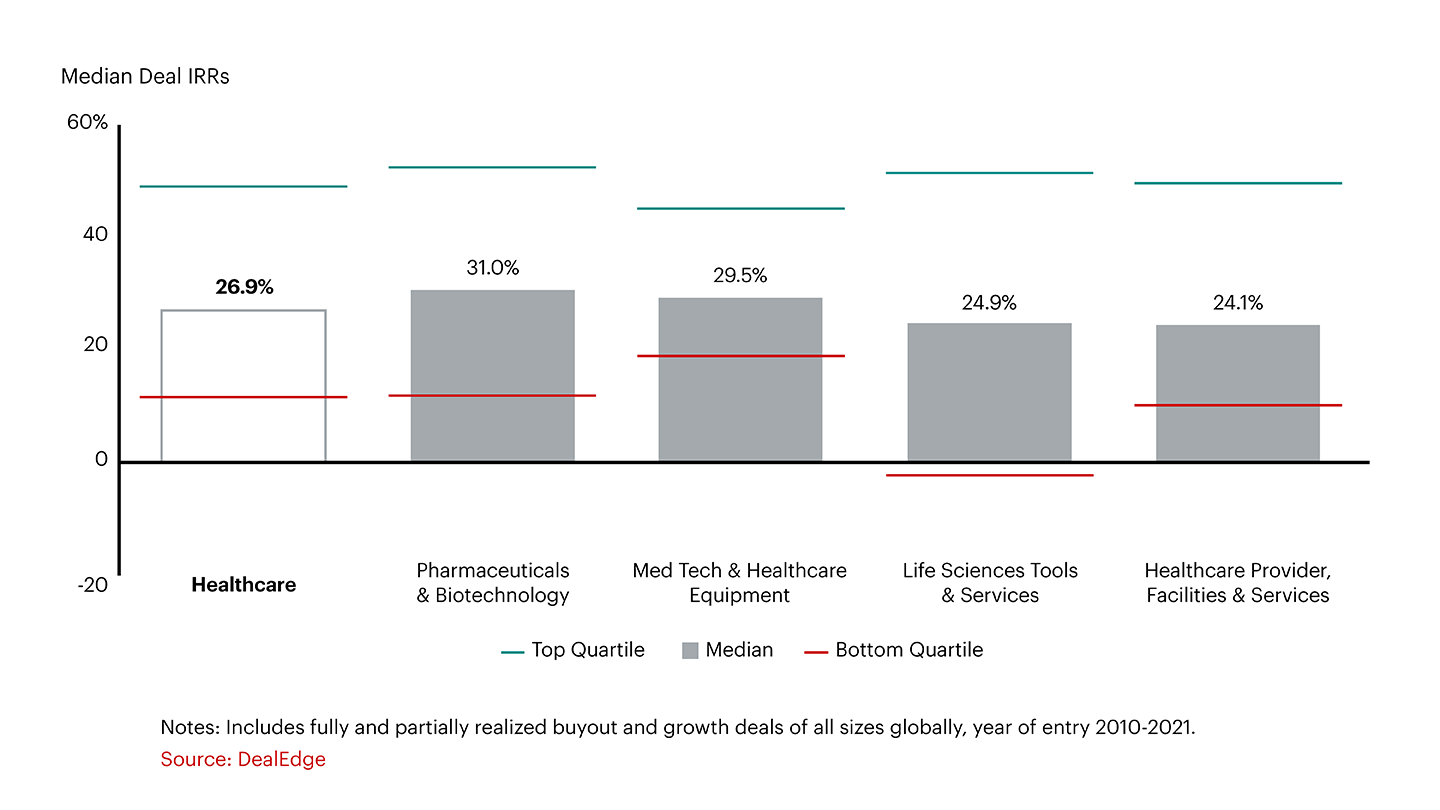

Compare against sector-specific performance benchmarks

Notes: Includes fully and partially realized buyout and growth deals entered globally 2010-2021.

Source: Median healthcare deal IRRs by industry groupDealEdge gives you a side-by-side comparison of deal performance across subsectors. It tracks more than 35,000 private equity deals across 20 metrics, from IRRs and MOICs to CAGRs and EBITDA margin change.

Its instant analysis means you can compare closely related subsectors and identify the most attractive opportunities. With filters to assess by time period, region, realization status, and more, you can build a comprehensive picture of how different subsectors stack up – without having to gather the data yourself.

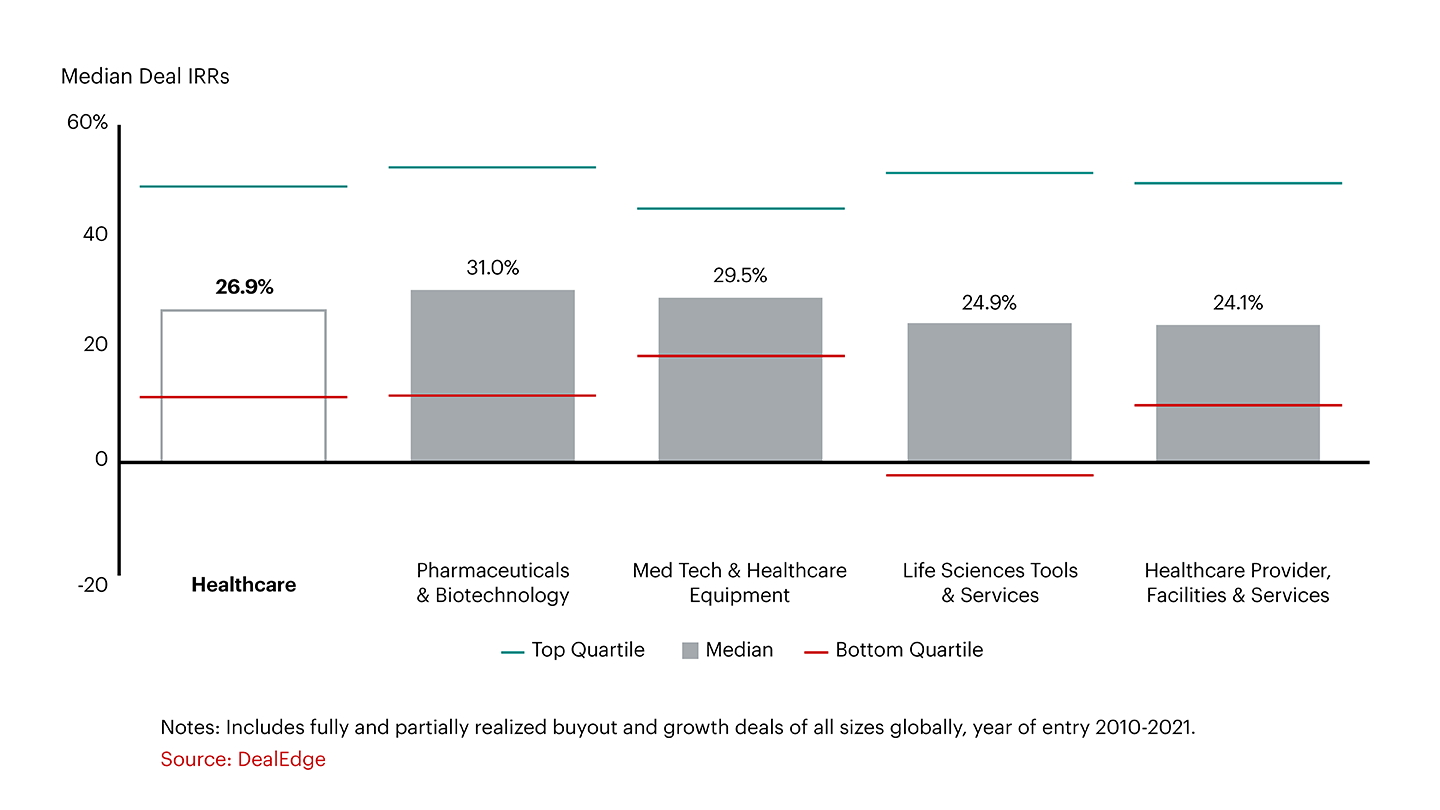

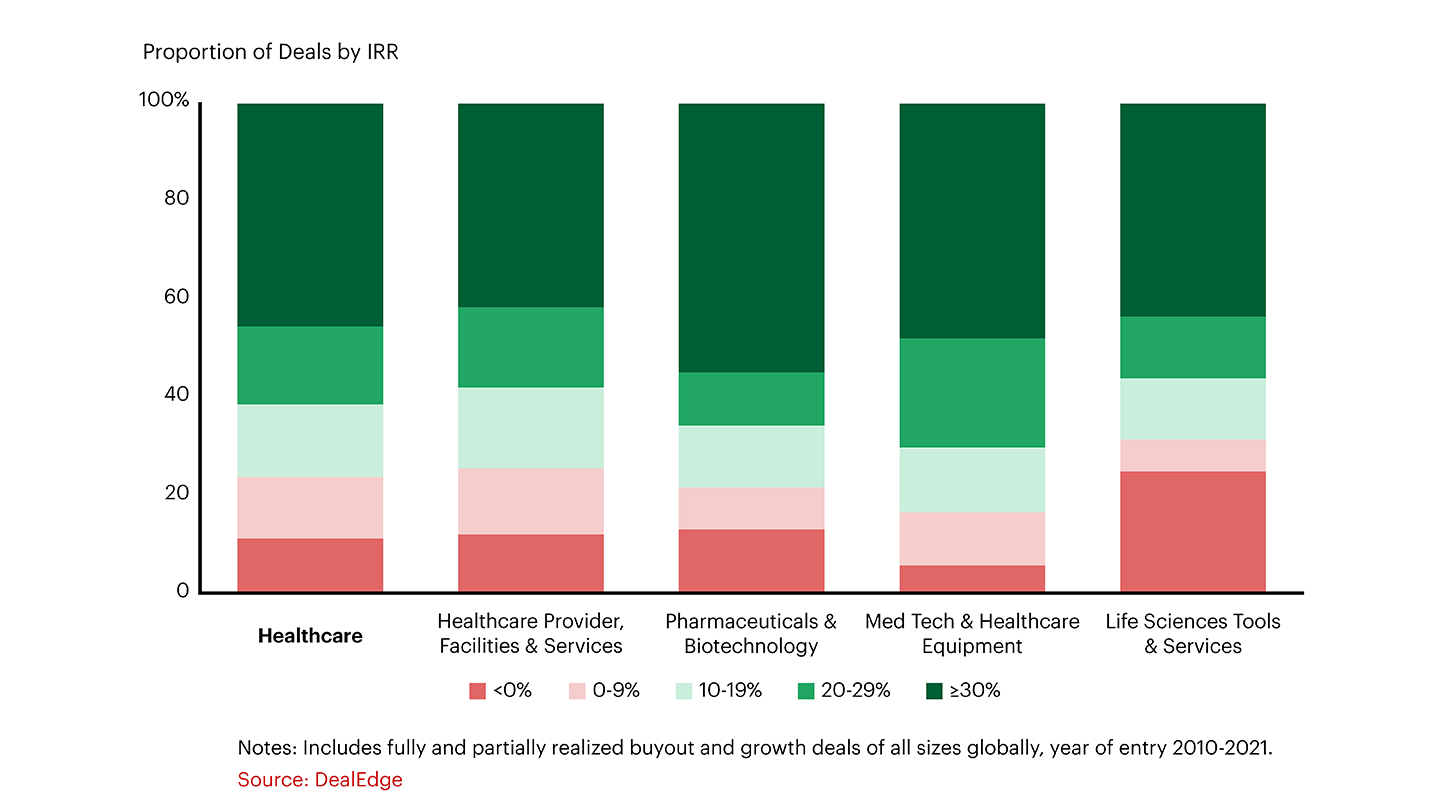

Identify attractive pockets of investment opportunity

Notes: Includes fully and partially realized buyout and growth deals entered globally 2010-2021.

Source: Proportion of healthcare deals by IRR across industry groupsFind the areas for investment that best fit your approach. Identifying subsectors with high top-level performance is not enough for most firms to adequately calibrate their strategy. With DealEdge, you can build specific profiles of the sectors that are most attractive for your individual approach.

As well as performance metrics such as IRRs and MOICs, DealEdge lets you see what proportion of deals achieved truly outsized returns, or which years of entry had the biggest gains. You can dig beyond top-line returns to fully understand the historical performance trends affecting each subsector.

DealEdge also lets you understand what value creation levers have yielded these results. See how similar businesses have built value with detailed breakdowns of value creation metrics like revenue growth and margin expansion. You can even evaluate downside risk potential, with breakdowns of loss rates and write-offs across more than 560 private equity industries.

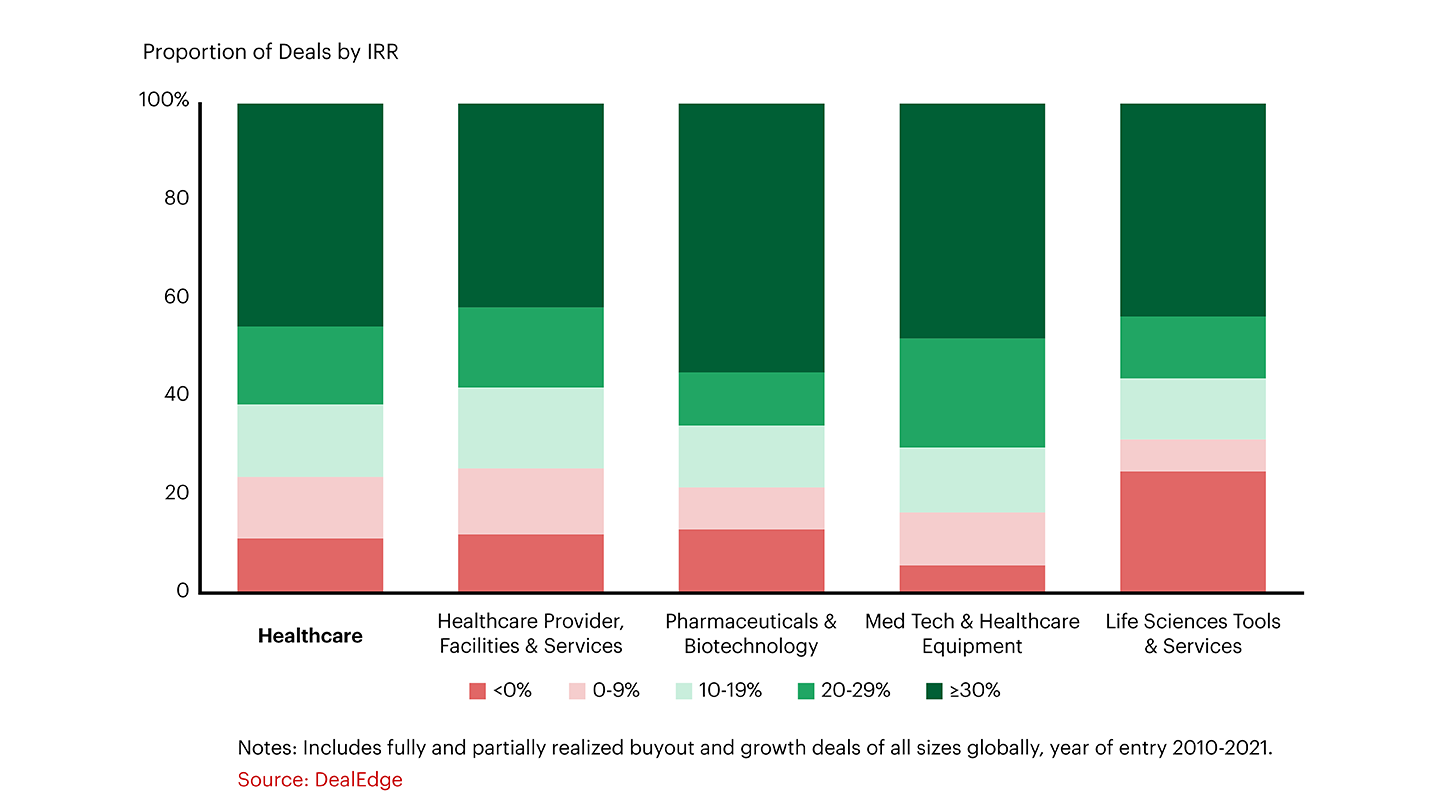

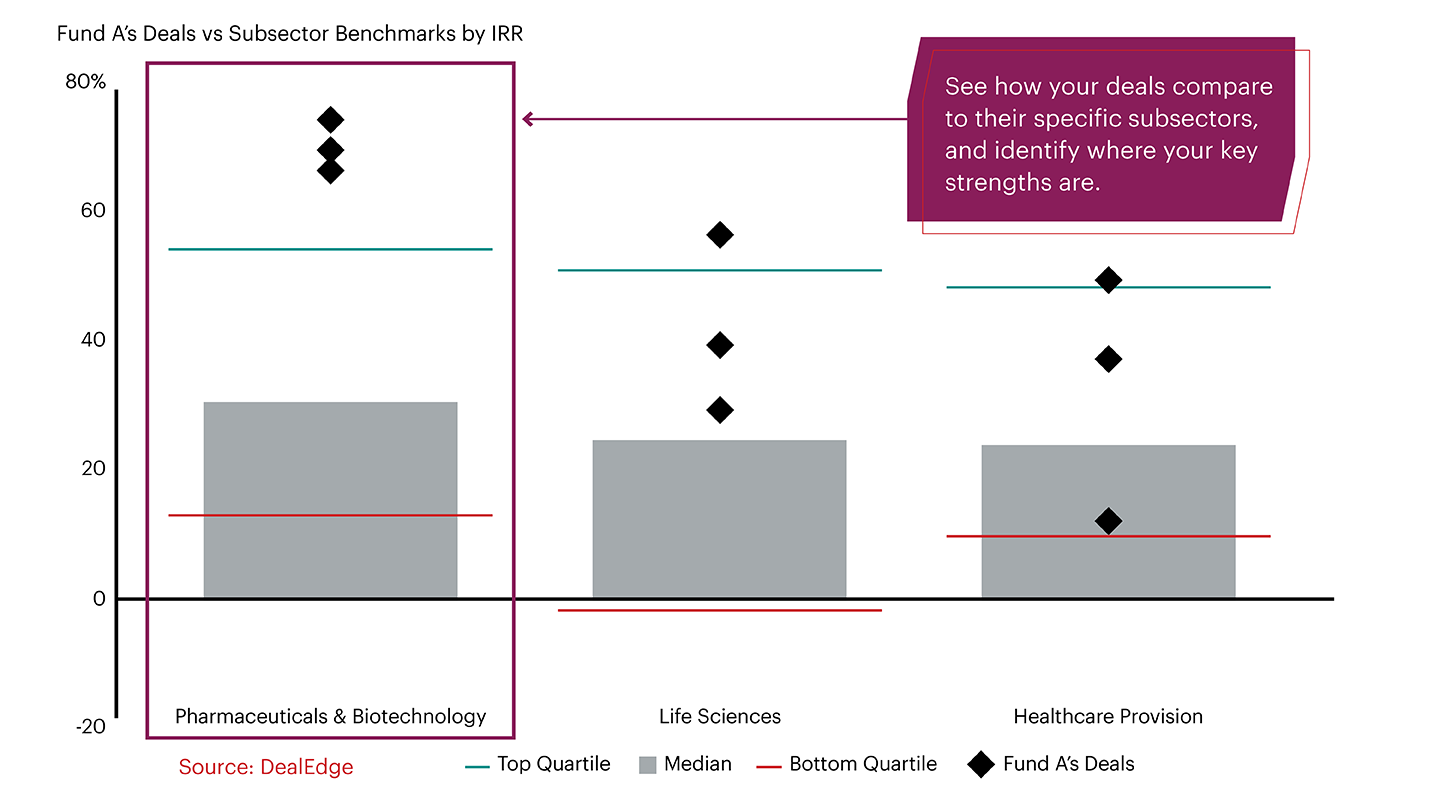

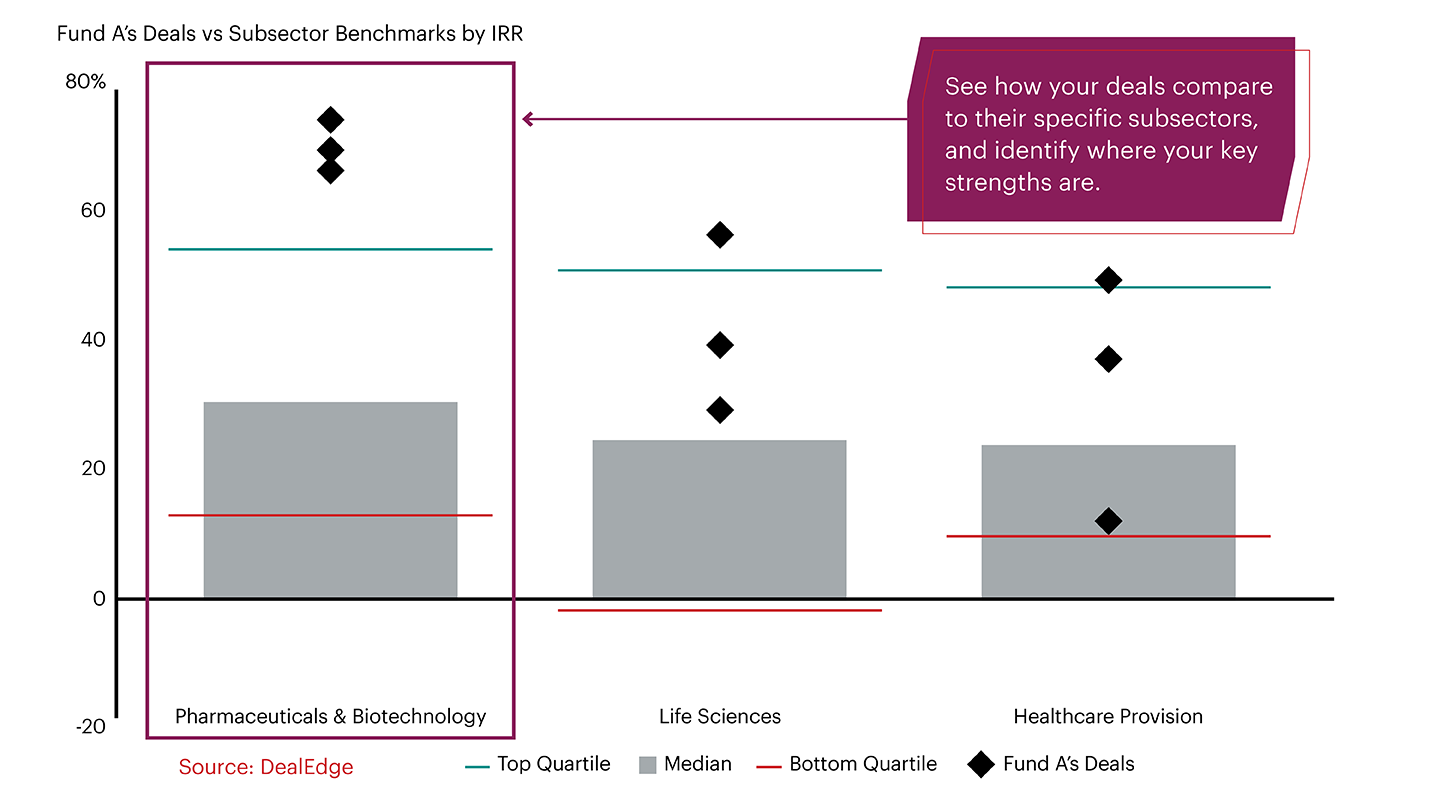

Understand where your performance strengths are

DealEdge’s sector-specific deal performance benchmarks give you unparalleled insight into the historical returns of more than 560 private equity subsectors. You can compare your past activity on a deal-by-deal basis against the most relevant sectors, giving you a deeper insight into where you’ve outperformed and where you’ve trailed the top quartile.

Notes: Includes fully and partially realized buyout and growth deals entered globally 2010-2021. Fund A dummy data.

Source: Median healthcare deal IRRs vs Fund A’s executed dealsWith DealEdge, you can identify areas where you have outperformed the market, and areas where your approach isn’t yielding top results. This intelligence gives you unprecedented context to help finetune your strategy on a level that commingled fund performance cannot emulate.

Calibrate your strategy efficiently

With DealEdge, you can access the consistent, comprehensive data you need to accurately compare the landscape in different sectors. Drill down into the performance and value creation profile of businesses in each subsector, and analyze the full context in which they are operating.

Don’t rely on anecdotal evidence or vague assumptions. Find the subsectors that are right for your approach, understand what is driving performance in those sectors, and calibrate your sector strategy more accurately and efficiently than ever before with DealEdge.

Sharpen your investment edge

Speak to us today and see how you can power up your private equity program

Request Demo